Risk Modernization | Implementing a modern technology architecture to accelerate risk transformation

Enable your risk and compliance function to meet—and even exceed—expectations

Building out a robust, “future-ready” risk function has become a top priority for forward-thinking organizations. However, the simultaneous pressure on businesses to deliver increased business value while also saving costs remains challenging thanks to a perpetually “uncertain” economy, rapid technology advances, and shifting regulatory and compliance requirements.

In fact, the pace of change across industries is quicker and more challenging than ever before. Organizations are buffeted by a myriad of disruptions, including new business models, evolving customer expectations, industry and regulatory shifts, the cost of innovation, the increasing complexity of big data, emergence of artificial intelligence (AI), and the need to ensure today’s workforce can embrace and deliver on the promise of these and other developments.

The good news is that approaches for developing the modernized technology architecture needed by organizations to improve, upgrade, and enhance their risk function are already here. Used strategically as part of a larger risk transformation, a robust technology architecture can help position the risk function to be more proactive and a source of competitive advantage for your organization that generates stakeholder trust, fulfills regulatory expectations, and empowers decision-making.

Harnessing technology for growth

Risk and compliance functions are expected to reliably contribute to deeper stakeholder trust, enterprise growth, and optimization. In response to these expectations, risk management needs a resilient and modern data and technology architecture strategy to facilitate the five risk transformation drivers and associated outcomes we’ve identified.”

Risk transformation achieved through modernized technology

Breaking down risk management silos

Organizations and their risk functions are ingesting information from a multitude of systems and solutions, but many of these legacy solutions were built to address a specific challenge or task. Suppose these systems are not integrated to standardize enterprise risk data collection. In that case, they force risk officers and business groups to go back and forth among various teams to gather and understand the information they need to assemble a complete picture of their organization’s risk exposure. That can be time-consuming, labor-intensive, confusion-inducing, and expensive.

Modern technology architecture is the foundational engine that organizations need to help elevate their risk function capabilities, add value to the business, and ultimately strengthen the bond with stakeholders. To achieve these objectives, it is critical for an organization to embark in both technological and organizational transformation—through both modern digital architecture risk solutions and embracing new ways of working with the business—to proactively identify, measure, monitor, and reduce risk.

Embrace integration

According to the KPMG 2023 CRO survey, 32 percent of respondents indicated that they are rapidly deploying advanced technology to enhance risk management functions. To maximize return on time and capital, organizations need a clear understanding of their desired architecture, and the focus to drive risk digitization efforts down that path.

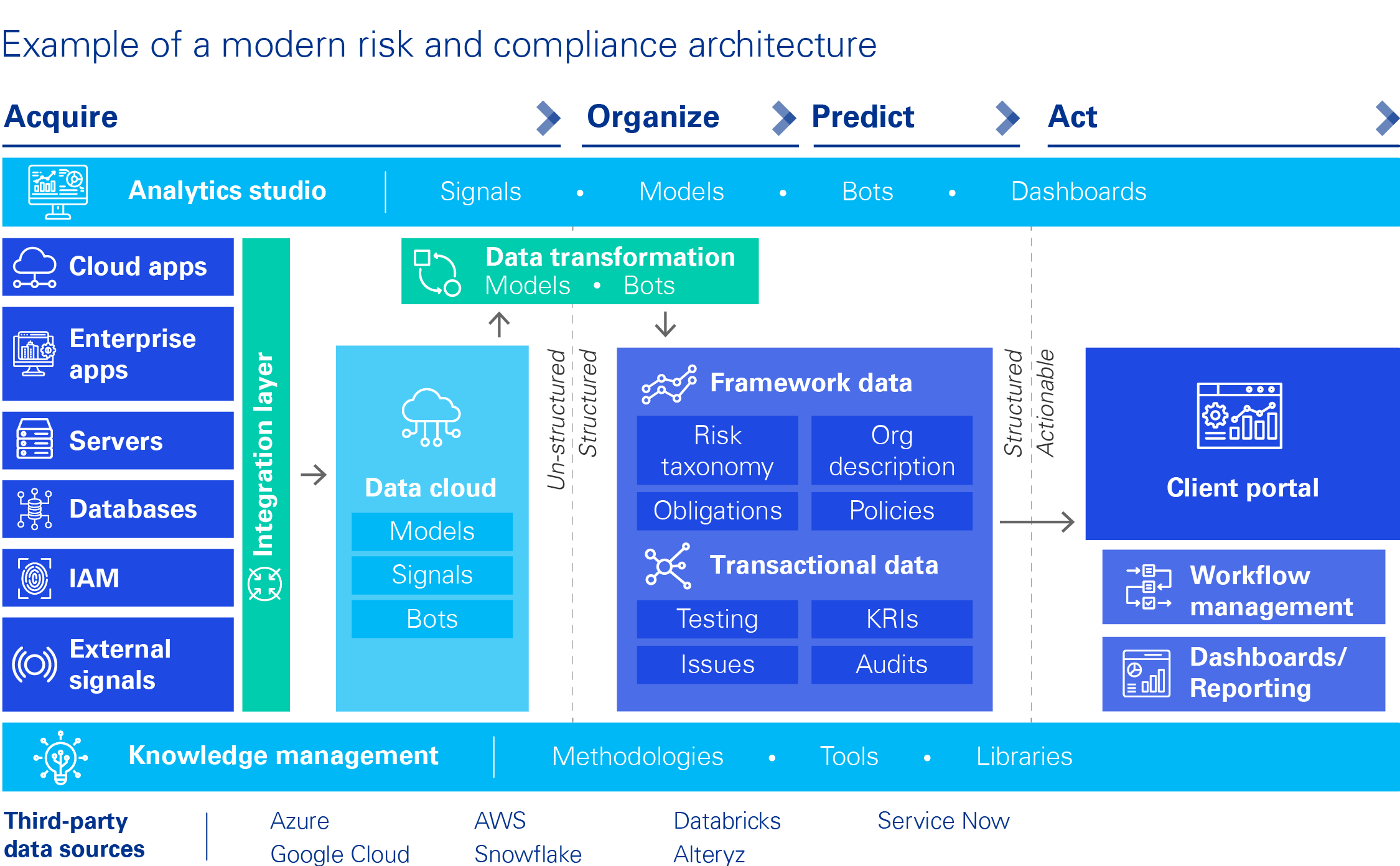

The goal, then, is to implement a modern, centralized risk technology architecture that can meet that objective—one based on both an integrated platform and solution strategy across the organization, and leverages powerful data analytic capabilities.

When done correctly, this can enable various risk and compliance processes by integrating data that can

be leveraged across functions to provide an enterprise perspective. Further, this modern risk architecture provides the foundation required for effective usage of artificial intelligence. This approach helps accelerate the maturity of the risk function, boost automation, reduce inefficiencies, provide insights to promote a proactive risk management posture, and, embed a culture of risk awareness across the business.

How a modern technology architecture can benefit your risk and compliance function

- Improved insights: With a common language and set of foundational data, information from multiple sources can be compared, combined, and evaluated with ease to deliver enhanced insights into the organizational risk profile and compliance status.

- Better decision making: With improved insights, organizational decision-makers can make strategic decisions from a genuinely risk-informed perspective, helping the organization to capitalize on opportunities and outperform its competitors.

- Enhanced capabilities: By taking a strategic approach to building an integrated risk capability, organizations can realize significant improvement in what they do and how they do it, adding more and better tools to their risk management toolkit.

- Build trust: Enhanced insights, high quality data and improved capabilities allow organizations to reliably achieve their objectives, thereby building stakeholder trust and protecting their reputation and relationships.

- Increased interconnectivity: A modern technology architecture helps to break down siloes and connect disparate processes, data and ways of working, improving collaboration, productivity and value-generation across all three lines of defense and realizing cross-domain synergies.

- Enhanced oversight: Enhanced capabilities, insights and data—coupled with real-time management information—help the organization to report with confidence, facilitating enhanced levels of internal and external oversight.

- Future-proofing the technology landscape: By investing time and resources into a modernized technology architecture, organizations set themselves up for continued long-term success and provide the foundation for transformative technologies, such as generative AI, to thrive.

The case for change

It’s no longer enough for risk functions to react to circumstances and, in turn, protect when those circumstances call for it. Their leadership is expected to rethink the very nature of risk and how it fits into an organization’s future, and, in turn, create new opportunities to act that previously were not even on the radar screen.

Risk functions that continue to use legacy technology and think they can generate the type of relevant outcomes expected of them today are at a great disadvantage. Instead, to achieve the type of measurable outcomes they seek requires a modern platform-based technology architecture as part of its arsenal of efforts. Without this modern technology platform, organizations can’t improve efficiency and flexibility, automate routine processes, and address risk-related issues internally before regulatory action is needed.

Where to start

- Set clear objectives – Determine the desired business objectives and optimal target-state.

- Translate objectives into measurable outcomes – Define priorities and KPIs to track performance and align expectations.

- Start small and win fast – Conduct pilot programs to limit exposure, moderate risks, achieve quick wins, build internal support, and reduce unintended outcomes, all while laying foundations for broader transformations.

- Think creatively – Be willing to cut ties with legacy approaches and consider new ways of solving old problems.

- Proactively engage with stakeholders – Promote active dialogue with business and functional stakeholders to ensure development of risk technology architecture that aligns with and supports business needs and regulatory expectations.

- Leverage diverse perspectives – Utilize the knowledge, experience, and perspectives of cross-functional employees to innovate in a smarter, more informed, consensus-driven manner.

- Develop multiphase roadmap – Outline a clear path forward that focuses on building foundational items to enable future cost savings and efficiency gains. Review and recalibrate often.

How KPMG can help

Our Risk Services team has deep experience supporting organizations in managing risk management in the most complex, fast-changing, and global business environments. Our practitioners deliver leading risk services to hundreds of client organizations with our organization of independent firms worldwide. We also help organizations build compliant, effective, efficient, and scalable risk management solutions with technology and automation to transform their risk programs. Learn more about how KPMG risk professionals can help your organization advance the risk imperative.

Dive into our thinking:

Risk modernization: Implementing a modern technology architecture to accelerate risk transformation

Download PDFExplore more

Risk Modernization | Cut costs, not quality

In this first article in our series, we explore practical approaches to reduce spend without sacrificing quality of risk management outcomes.

Risk modernization | Digital Acceleration

Unlocking the potential of digital acceleration in risk management.

2023 Chief Risk Officer Survey

Navigating compounding threats and emerging opportunities in a fast-moving world

Risk insights

Explore the latest webcasts and insights

Meet our team