Risk modernization | Digital Acceleration

Unlocking the potential of digital acceleration in risk management.

Standing at the intersection of risk modernization and digital acceleration

Welcome to the second in a series of articles focusing on risk modernization and the challenges and opportunities it presents. Done correctly, risk modernization provides the risk function and the overall organization with an array of benefits related to efficiency, effectiveness, growth, and compliance.

In our first article, Risk Modernization | Cut costs, not quality, we explored overall risk transformation drivers (Exhibit 1) with a focus on cost takeout and practical approaches to reduce spend without sacrificing quality, including the digitization of risk.

The focus of this article is about rapidly shifting behaviors and tasks from manual to digital. For years, technology has been driving incredible change across the business ecosystem. In turn, this rapid evolution is creating opportunities to enhance traditional approaches to risk management while maintaining pace to manage new and emerging risks. Leading organizations are implementing strategic efforts to adapt to evolving circumstances and digitally accelerate the risk function. In this article, we will explore the building blocks of digital acceleration and innovative technologies to transform the way the risk function is approached today.

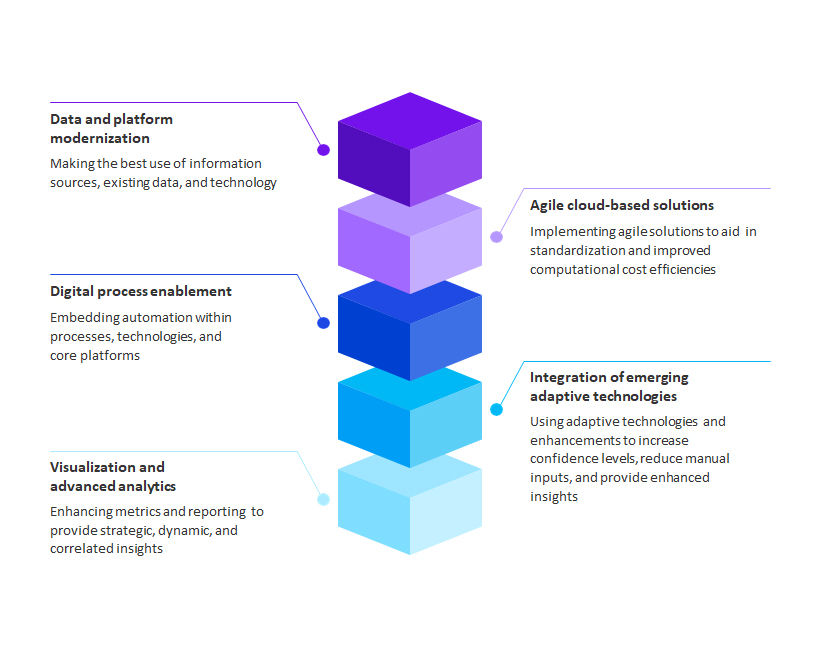

Exhibit 1: Risk transformation achieved through data acceleration

The building blocks of digital acceleration

Historically, digitization efforts primarily have been attributed to front-office operations, and efforts to automate and accelerate risk management often trail behind. But it is not too late to begin or benefit from the effort of digitally accelerating risk management to create a pathway for a more efficient, responsive, and cost-effective risk function.

Digital acceleration enables an organization to drive effective risk management within first-line operations while allowing the second line to deploy enhanced and more strategic oversight. When done right, it creates a business environment that is purposeful and controlled by design. This leverages emerging technologies to offer better insights, fuel efficient oversight, and provide the ability to respond more quickly to new risks, all while offering scalability for future growth.

Whether within the front office or the risk management function, digitization can be broken down into five key acceleration methods or “building blocks.” This means organizations can approach digital acceleration using the following building blocks individually or in combination to provide an even greater impact on the overall acceleration effort (Exhibit 2).

Exhibit 2: The building blocks of digital acceleration

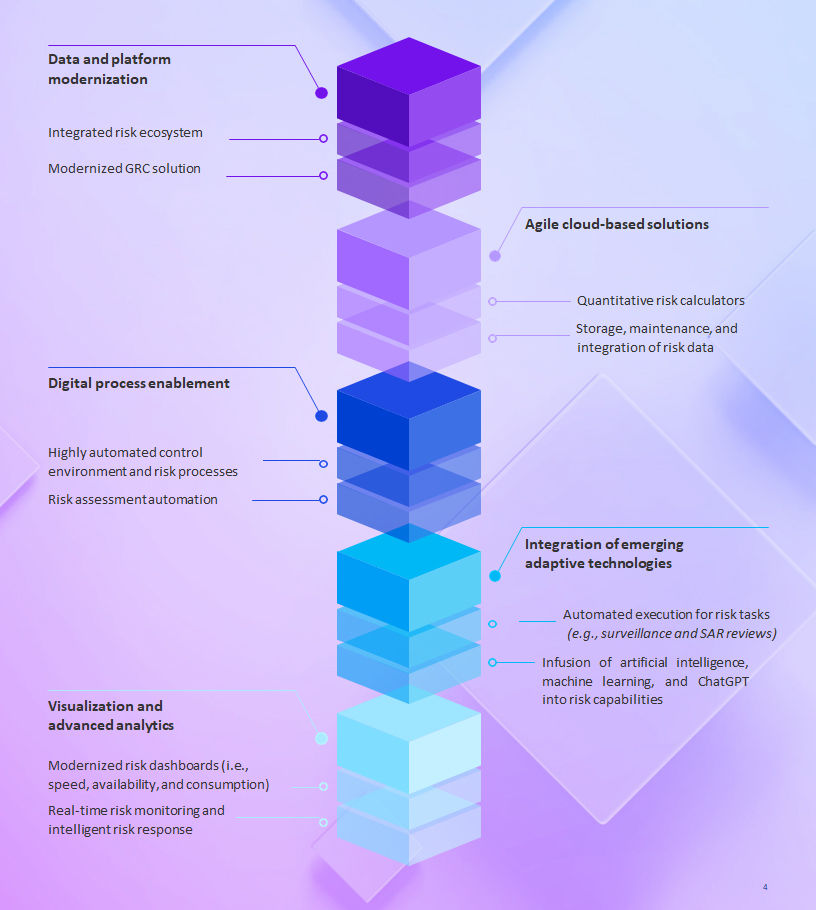

These building blocks can come in different shapes and sizes for risk management (Exhibit 3). The possibilities are endless and the applications limitless for your organization to explore.

Exhibit 3. Examples of digital acceleration efforts for risk management

No matter where organizations are on their digital acceleration journey, a multitude of benefits can be achieved—not only specific to the risk function itself, but also to its broader enterprise-transformation aspirations (Exhibit 4). Through the adoption of digital acceleration strategies and methods, the risk function can take part in the return on investment back to the business on digital investments. This can further contribute to growth and cost reduction, among other benefits, as well as drive greater efficiency, sustainability, and effectiveness across the organization.

Exhibit 4. Potential benefits of the digital acceleration journey for risk management

Digitization efforts within risk can come in many forms, and face challenges to fully optimize all of their specific risk operations. As the following three case studies demonstrate, there are practical steps that leading organizations have taken to begin this journey.

Kickstarting a digital acceleration: Immediate next steps

Given the stakes, specific actions in pursuit of digital acceleration should be undertaken with great care. Considering the unique nature of each organization and its industry-specific digital transformation drivers, organizations should, prior to taking action:

1

2

3

4

5

6

Case study #1

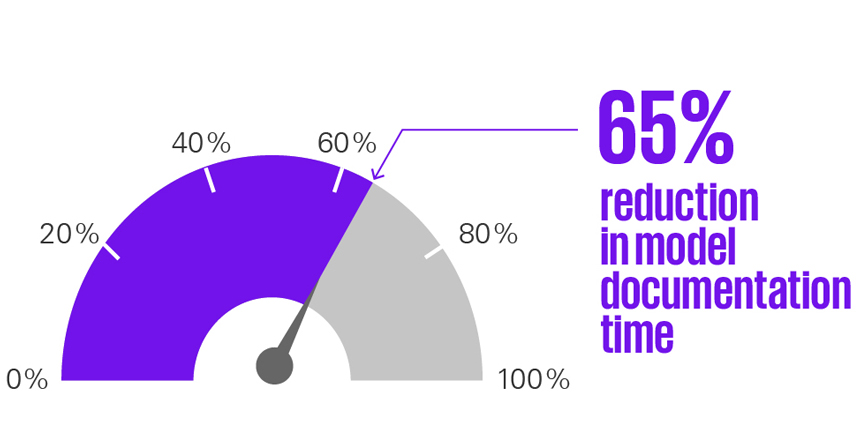

Integration of emerging adaptive technologies

With KPMG support, a Fortune 50 company was able to automate model documentation processes with user- friendly SAS, R, and Python tools. This reduced model documentation time from 20 days to 7 days (65 percent reduction) and drove overall model development process efficiency.

Case study #2

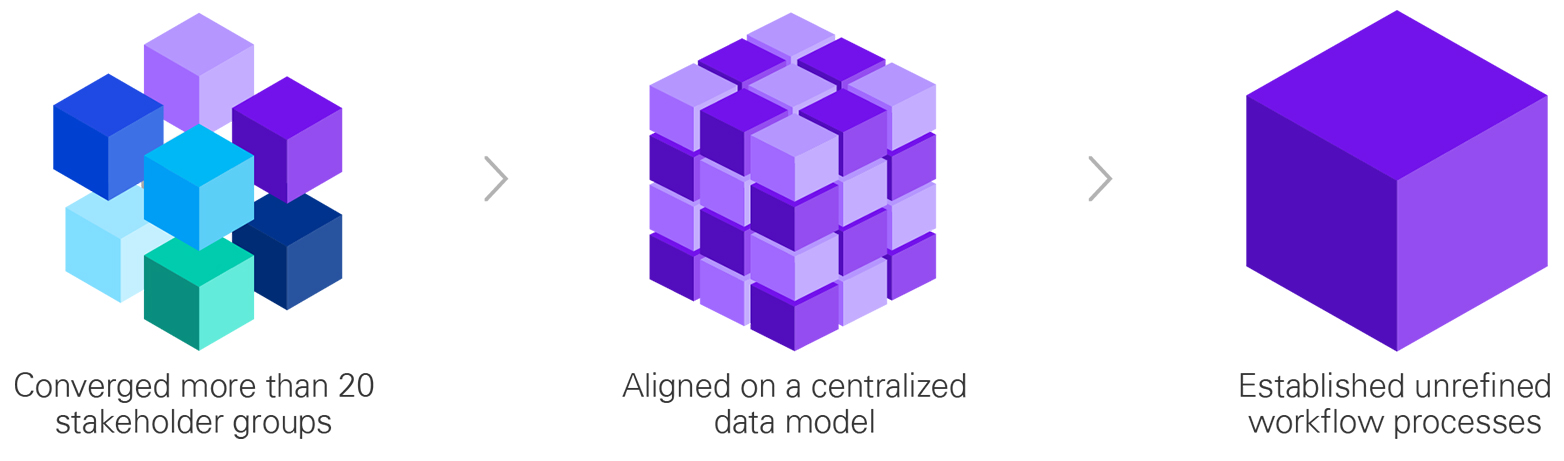

Data and platform modernization

KPMG helped a global telecommunications company transform and digitize how it performs risk and compliance activities through modern GRC technology capabilities. This process included converging more than 20 stakeholder groups to align on a centralized data model, establishing common and unified digital workflow processes, enabling mobile-ready solutions, and driving integrated reporting to promote enterprise insights at the executive level.

Case study #3

Integration of emerging adaptive technologies

A leading financial services firm, in collaboration with KPMG, enabled rapid prioritization and near real-time escalation of market manipulation surveillances. The firm was faced with a rules-based surveillance process that generated a high volume of false positives requiring costly, manual disposition. Using machine learning to tune and optimize surveillance thresholds to minimize "poor quality" alerts, the process was enhanced to produce live risk score alerts to reduce costly, time- consuming false positives by more than 20 percent.

These “next steps” are only part of a longer journey toward digital acceleration. We believe that once you begin—and, more importantly, once you begin to achieve results—there will be more opportunities to digitally accelerate your risk function. Ultimately, digital acceleration within risk and the broader digital transformation efforts underway within your organization can help future proof both the risk function and the entire organization. This process offers room for innovation and provides new opportunities to reduce costs, improve decision-making and, perhaps most importantly, protect and preserve your business while propelling it to new heights.

How KPMG can help

KPMG helps clients along every step of the risk transformation journey, including digital acceleration, from identifying strategic enhancement opportunities to executing against them. While the first article in this series explored cost takeout and this second article focuses on digital acceleration, future articles will focus on evolution of risk resources and modernizing technology architecture. To learn more about any of the topics in this series, please reach out to our authors.

Dive into our thinking:

Risk Modernization | Digital Acceleration

Download PDFExplore more

Risk Modernization | Cut costs, not quality

In this first article in our series, we explore practical approaches to reduce spend without sacrificing quality of risk management outcomes.

2023 Chief Risk Officer Survey

Navigating compounding threats and emerging opportunities in a fast-moving world

Risk Modernization

Enabling insight. Embedding resilience. Creating value.

Meet our team