Venture Pulse Q1 2024

The Venture Pulse report provides insights around trends, opportunities, and challenges in the U.S. venture capital market.

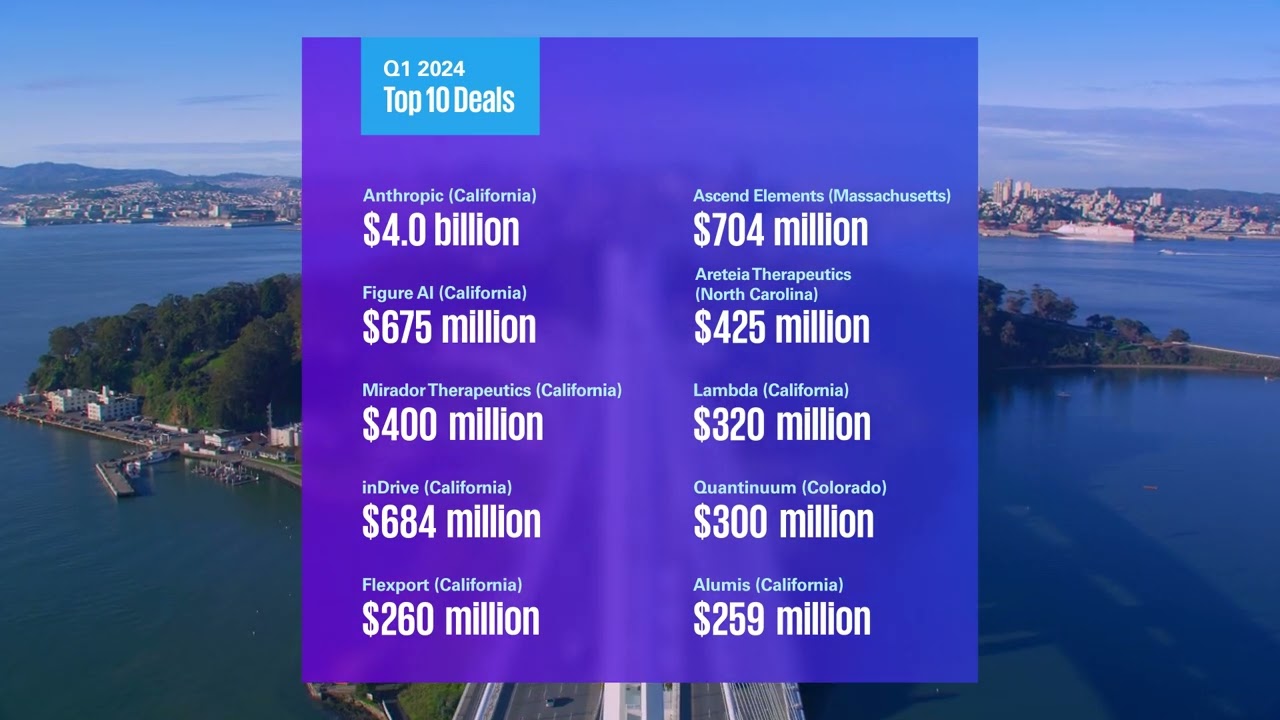

VC investment in the US fell from $40.1 billion in Q4’23 to $36.6 billion in Q1’24, while deals volume dropped from 3,457 to 2,882 over the same period, as VC investors continued to show caution when making large deals given the protracted lack of exit opportunities. AI and cleantech accounted for the biggest deals of the quarter, with AI firm Anthropic raising $4 billion, a $704 million raise by battery company Ascend Elements, and a $675 million raise by Figure AI.

Slowing deals activity trickling down to earlier deal stages as IPO door remains closed

The IPO window in the US remained mostly closed in Q1’24, leading to a continued slowdown in deals activity. While later stage deals remained the most affected, in Q1’24, the slowdown started to become more noticeable at Series B and earlier deal stages.

Exit activity in the US remained very dry during Q1’24. Social media company Reddit was the most notable exception; the company raised $748 million in its debut on the NYSE in March, with shares up 48% at the end of the first day of trading —although the share price has moderated in the days since. While Reddit held a successful IPO, it is not being viewed as a clear indicator of the overall IPO window reopening but could be a precursor for other companies of a similar maturity in the US. It could, however, provide some impetus to other large companies looking to test the IPO waters. Biotech companies also saw some success in the IPO markets during Q1’24 —although at much smaller deal sizes.

There are a lot of eyes on the IPO market right now. Hopefully we see a couple of successful IPOs in Q2’24 and then others follow on —creating the value and the wealth that can then be put back into the market. If we do see a couple of successful IPO exits or companies indicating that they’re going to go, we’ll start to see VCs loosening their purse strings, in part because their LPs will start putting pressure on them to invest.

Conor Moore

Global Head, KPMG Private Enterprise

AI investment remains red hot

Interest in AI remained very strong among VC investors in the US in Q1’24, led by the $4 billion raise by Anthropic. VC investors showed a willingness to write cheques even for small percentages of companies in order to get into the game. This investment frenzy is likely to slow in the near term as the largest players continue to gain traction and others lose steam. Interest in AI will likely begin to shift towards companies with unique value propositions, including industry specific solutions and tools and to companies able to prove the value of their tools in terms of enhancing productivity or reducing headcount.

Investors pulling back on bridge financing driving more cost cutting

In 2023, startups looking for bridge financing were a relatively common occurrence given the number of companies looking to delay new funding rounds given the downward pressure on valuations and those pressing pause on their IPO plans amid the dry exit environment. In Q1’24, existing investors pulled back from making such investments, putting more pressure on companies within their portfolios to cut costs in order to extend the runway of any previously received funding.

M&A activity remains soft as regulatory issues come to the forefront

M&A activity remained stalled during Q1’24, driven by a number of factors, including higher interest rates making it more expensive for companies to conduct acquisitions. The regulatory climate also kept M&A activity subdued during the quarter, with the FCC rejecting a number of large deals. This could have an impact in terms of mega mergers, given the lack of certainty over which deals might be approved.

US continues to focus on developing onshore semiconductor manufacturing capacity

In Q1’24, the US showed its continued commitment to creating a robust environment for onshore innovation —in particular, incenting US-based semiconductor manufacturing as part of the 2022 CHIPS Act. During the quarter, the government announced $8.5 billion in funding to Intel to support the development of chip manufacturing facilities and research centers in four US states. These and similar investments are expected to help drive long-term innovation capacity in the US.

Trends to watch for in Q2’24

The percentage of down rounds is expected to continue to climb in Q2’24, although there will likely also be a growing number of companies going out of business as a result of running out of cash due to the inability to raise funding. M&A activity is also expected to pick up in Q2’24 as startups without a clear path to IPO or the ability to raise funds look to sell.

While AI has taken a lot of attention from VC investors in recent quarters, interest in quantum computing solutions is expected to see renewed interest over time. Software is also expected to remain attractive to investors, particularly companies with business models predicated on recurring revenue streams.

Companies that have got true generative AI solutions —so the large language models and the like —those are the startups that are going to be funded the most because there’s a lot of FOMO there. But the next wave of AI investment is likely to be more targeted, more vertical or industry specific, such as solutions targeted towards documentation, task-heavy industries like fintech, real estate, and proptech where the value of AI is potentially very significant.

Francois Chadwick

Partner, KPMG Private Enterprise

Key insights from Venture Pulse Q1 2024

In the U.S. in Q1’24

1

2

3

4

5

Dive into our thinking:

Venture Pulse Q1 2024

Download PDFQ1’24 Venture Pulse Report – Global trends

A global overview of key findings uncovered from the Q1’24 Venture Pulse Report.

LinkedIn Live Event: When will the IPO flame be reignited?

Hear KPMG Private Enterprise professionals discuss highlights from the latest Venture Pulse report.

About the Pulse Series

Explore more

KPMG Private Enterprise Tech Innovator in the U.S.

Making a difference in the world, one innovation at a time

High-growth Company IPO Journey

Understanding the IPO journey

Challenges of Hiring When Scaling

Hiring the right people to help grow your organization

Subscribe to Private Enterprise insights

Subscribe to receive pertinent information that will help you drive value for your private company.

Meet our team