Consumer Complaints: CFPB Analysis of 2023

Key Findings and Insights from Over One Million Complaints

KPMG Insights:

- Consumer Complaints. CFPB receives nearly 1.7 million consumer complaints in 2023; 1.35 million sent to companies for review and response.

- Fraud: Consumers raise fraud-related issues across nearly every product, including checking or savings accounts, credit cards, virtual currencies, and prepaid cards.

- Rising Reporting Issues. Nearly 80 percent of complaints relate to credit or consumer reporting; in total, this complaints category shows a 34 percent increase in volume over 2022.

_______________________________________________________________________________________________________________________________________

April 2024

The Consumer Financial Protection Bureau (CFPB) issues publishes the annual Consumer Response Report highlighting analysis of 2023 consumer complaints.

Key Findings

The CFPB reports receipt of nearly 1.7 million complaints, forwarding almost 1.35 million of those complaints (approximately 81 percent) to companies for review and response while referring another 6 percent to other regulators. The CFPB highlights:

- Fraud: Consumer complaints allege fraudulent activities across most product categories (e.g., credit or consumer reports, debt collection, checking or savings accounts, credit cards, virtual currencies, prepaid cards).

- Credit Reporting: The most common complaints concern credit or consumer reporting (e.g., incorrect information, untimely investigation, unauthorized credit inquiries, and credit access due to errors and inconsistencies in reports (particularly for consumers from predominantly minority communities).

- Debt Collection: The second most common complaints concern debt collection, with many consumers not recognizing the debt being collected.

- Payments & Loans: Other complaints relate to payments and loans, including cards, bank accounts, and money transfers, as well as mortgage, auto, student, and consumer loans. In particular, complaint volumes related to payment transactions are being driven by transaction disputes and fraud, as well as by what is denoted as poor customer service or explanations during issues resolutions.

The consumer complaint findings include analysis by:

- Products and services

- Geographic region

- Special population (servicemembers and older consumers)

1. Products and services

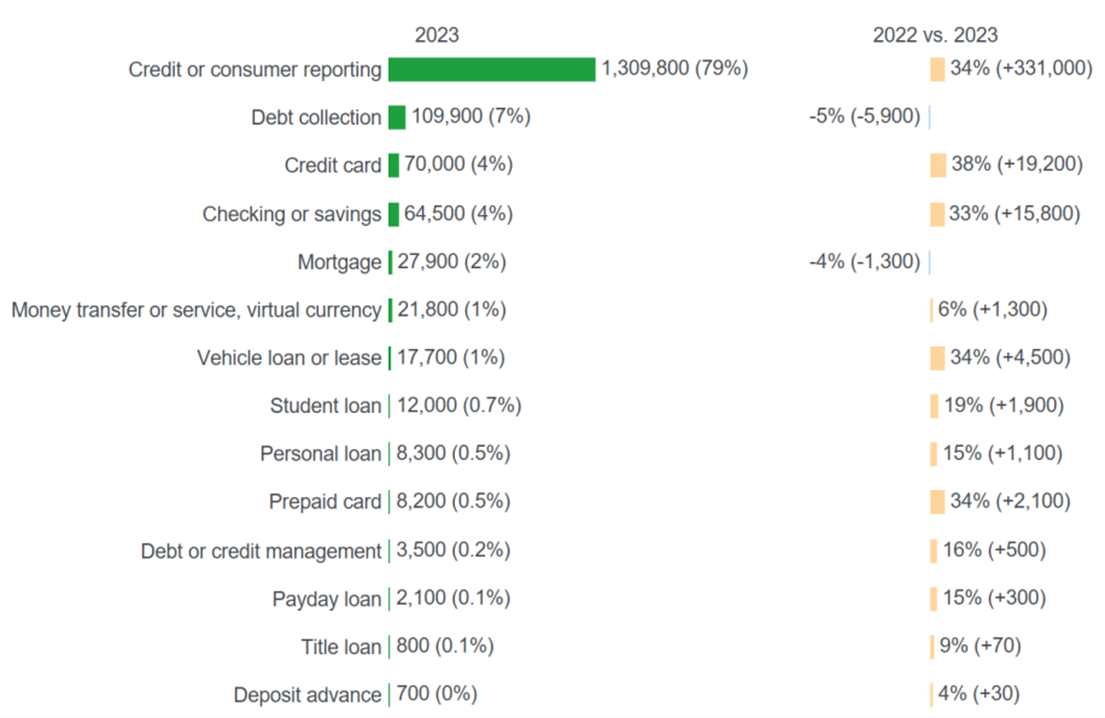

Of the total 2023 complaints received, the report notes that 96 percent of all complaints were related to credit or consumer reporting, debt collection, credit card, checking or savings accounts, or mortgages (as shown in the figure below). In comparison to complaints received in 2022, complaints related to credit or consumer reporting, credit cards, and checking or savings accounts increased by 30 percent or greater, while the volume of debt collection and mortgage complaints decreased slightly.

Source: CFPB Consumer Response Report, 2023

Note: Though small in total volume, notable increases in complaints within product categories include general purpose credit cards (76 percent), certificates of deposit (96 percent), and savings accounts (80 percent).

2. Geographic location

Consumers across all U.S. states and territories submitted complaints, with the most complaints being submitted from these five states:

State | # of reports (per 100K population) |

|---|---|

Georgia | 1,166 |

Florida | 1,018 |

Washington D.C. | 980 |

Delaware | 912 |

Nevada | 894 |

3. Special populations

Servicemembers. Servicemembers, veterans, and military families (collectively, “servicemembers”) providing their servicemember affiliation submitted 84,700 complaints (5.1 percent of the total complaints received by the CFPB). When compared to all complaints from all consumers, servicemembers submitted a lower rate of complaints related to credit or consumer reporting, but higher rates related to all other types of products and services.

Older Consumers (Age 62 or Older). Self-identified older consumers (those age 62 and older) submitted 332,400 complaints (20 percent of total complaints received by the CFPB). When compared to complaints from consumers below age 62, older consumers submitted a lower rate of complaints related to credit or consumer reporting, but higher rates related to credit card, check or savings accounts, debt collection, and mortgages.

Company Review and Response to Complaints

The report notes forwarding complaints to more than 3,400 companies, requiring: 1) Review of the information provided within the complaints, 2) Communication with the consumer(s) (when needed), and 3) Determination of actions to be taken and provision of written responses to both the CFPB and the consumer(s). Regulators monitor complaint responses by companies, with evaluation based on:

- Completeness: Addressing all issues raised by the consumer, including providing relevant documentation.

- Accuracy: Selecting the appropriate response categories (e.g., “closed with monetary relief,” “closed with non-monetary relief,” “closed with explanation,” and “administrative response”) in written responses provided to consumer(s), including (when appropriate) description of non-monetary or monetary relief provided.

- Timeliness: Providing responses within fifteen (15) calendar days of the complaint being sent to the company, or, if a complaint cannot be closed within that time, providing an interim explanation to the consumer and the CFPB within fifteen (15) calendar days followed by a final response within sixty (60) calendar days of the complaint being sent to the company.

The CFPB states that companies closed approximately 20 percent of complaints within the first 15 days and that nearly all (99.6 percent) were closed within the final response period of 60 days.

Note: The CFPB encourages companies to use complaints as “indicators for potential product or service weaknesses” and to integrate complaint information into their institutional processes in order to detect issues early and quickly address them.

Dive into our thinking:

Consumer Complaints: CFPB Analysis of 2023

Key Findings and Insights from Over One Million Complaints

Download PDFExplore more

Points of View

Insights and analyses of emerging regulatory issues and their impact.

Regulatory Insights View

Series covering regulatory trends and emerging topics

Regulatory Alerts

Quick hitting summaries of specific regulatory developments and their impact.

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team