In an uncertain world, Latam M&A is on the rise

KPMG 2023 M&A in Latam Survey

Introducing the KPMG global survey on M&A in Latin America

The risk-reward dynamic is clear when it comes to M&A in Latin America. But how can companies and investors successfully navigate it? Against a backdrop of global turmoil and disruption in other major regions, Latin America’s star is rising.

KPMG is pleased to present its 2023 outlook on M&A in Latin America. In March and April 2023, KPMG carried out research into M&A trends in Latin America. We surveyed 400 business leaders who have been involved in M&A investments worth more than US$50 million in the past five years, or have advised on such an investment in any capacity over the same period. Respondents included private equity and venture capitalists, corporate executives and M&A advisors from around the world.

The results are clear, M&A in Latin America is full of opportunities—but there are some risks. How can investors and corporations win in this environment? This report examines the M&A landscape in Latin America and recommend ways for investors and companies to take advantage of the growing opportunity.

The opportunities for M&A in Latin America are plentiful, but successful execution of these relies heavily on having deep expertise within the region: local cultures, customs and regulations can take investors by surprise. This is a risk but, overcome it and the rewards can be significant.

Jean-Pierre Trouillot

Latin America Deal Advisory and Strategy Leader, KPMG US, Partner

Mexico takes the top spot

Traditionally, Brazil has been the most attractive country for M&A activity in Latin America because of the size and stability of the market, its natural resources and its strategic location.

But our survey suggests that a shift could be under way: 79 percent of companies and investors rate Mexico as an attractive place to do business, ahead of 69 percent for Brazil.

Key findings

Most attractive countries for M&A

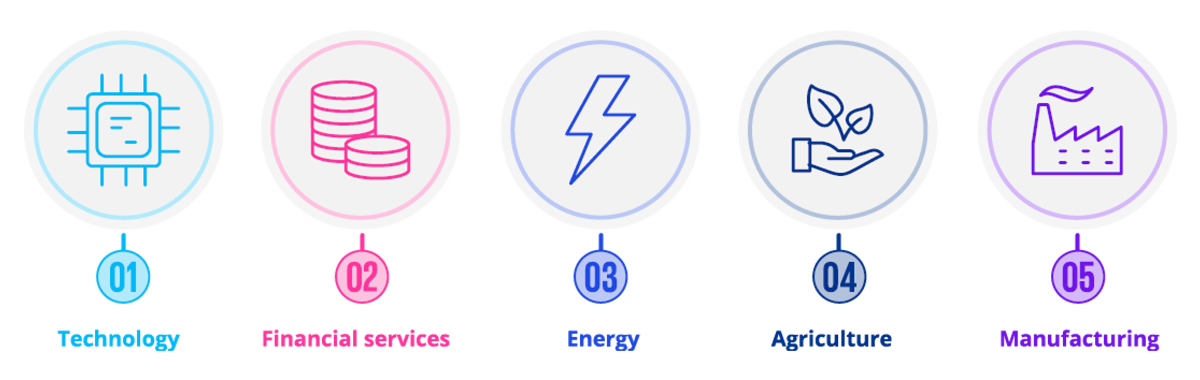

Most attractive sectors for M&A

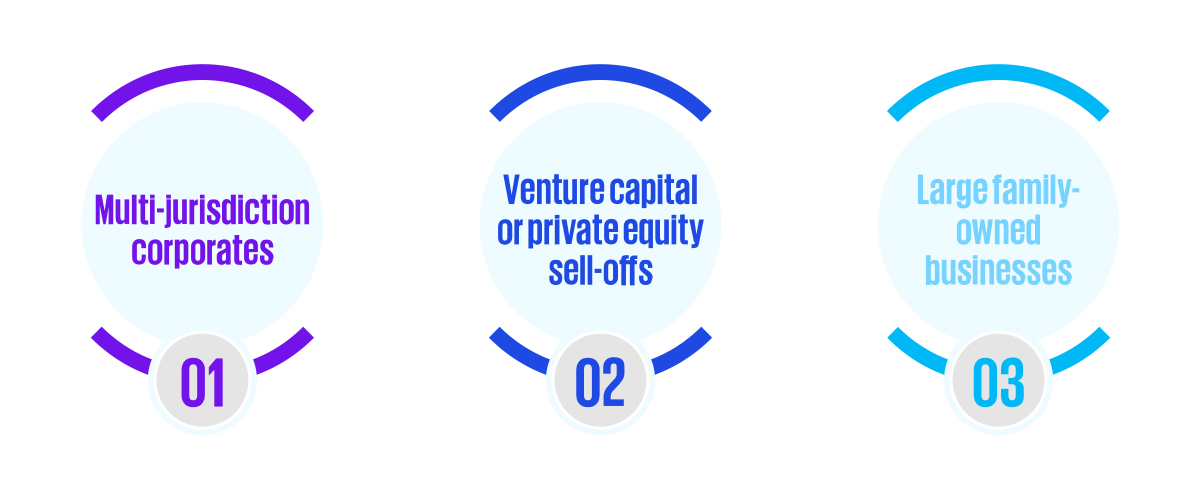

Most attractive types of compaines for M&A

Deals are succeeding

Deals of all types are expected to increase in Latin America. The majority of investors and companies expect the number of acquisitions to go up in the next two years, as well as deals from within and outside of the region.

The highest numbers of investors and companies expect increases in the following:

60%

Private equity buyouts

57%

Private equity sales

56%

Sales of corporate carve-outs

Private equity funds had a very strong year in 2022 in terms of total investments in Brazil. This was led by a range of factors, including a more stable political and economic outlook, a devalued currency and investors moving away from other emerging markets, with financial services and information technology being the main investment targets.

Marco André Almeida

Head of Deal Advisory and Strategy, KPMG Brazil, Partner

Importance of due diligence

M&A opportunities are abundant in Latin America, and companies and investors are satisfied with how these have gone: four out of five companies and investors rate their most recent large M&A deal in the region as a success on the whole. This is significant: widely referenced data from the Harvard Business Review suggests that the failure rate of M&A deals across the board is between 70 percent and 90 percent. But there are challenges, and these continue throughout the life of the deal.

43%

Forty-Three percent of companies and investors say they are not good due diligence.

1/3

More than a third of companies and investors rate themselves as mediocre at best across key areas of the deal, such as target identification, strategy and integration.

21%

A fifth (21 percent) say insufficient due diligence was the biggest lesson they learned from their last major M&A deal in the region.

Technology sector is the high achiever of Latin American deals

More than a third (36 percent) of companies and investors in the survey say they are drawn to Latin America because of growth in specific sectors; this is among their top reasons for investing in the region.

Three ways to make Latin American M&A more rewarding than risky

Do not underestimate the challenges — or the opportunities — of Latin America. That is the message that comes through from the investors and companies in our survey. Here are their top three lessons from conducting M&A in the region.

Do not ignore people and culture

Companies and investors are keen to stress the importance of understanding the culture, languages and ways of working in Latin America. For many, this is the key to success in the region.

Never misjudge how long it can take to close the deal

M&A activity can be a slow process, and doing deals in new territories and sectors only adds to the time it takes to complete.

Plan the integration process properly

Integration-planning is crucial to deal success, according to the companies and investors in the survey.

About the research

In March and April 2023, KPMG5 carried out research into M&A trends in Latin America. We surveyed 400 business leaders who have been involved in M&A investments worth more than US$50 million in the past five years, or have advised on such an investment in any capacity over the same period. Respondents included private equity and venture capitalists, corporate executives and M&A advisors.

Dive into our thinking:

In an uncertain world, Latam M&A is on the rise

Read the full report to learn more about the risks and rewards of M&A in Latam

Download PDFMeet our team