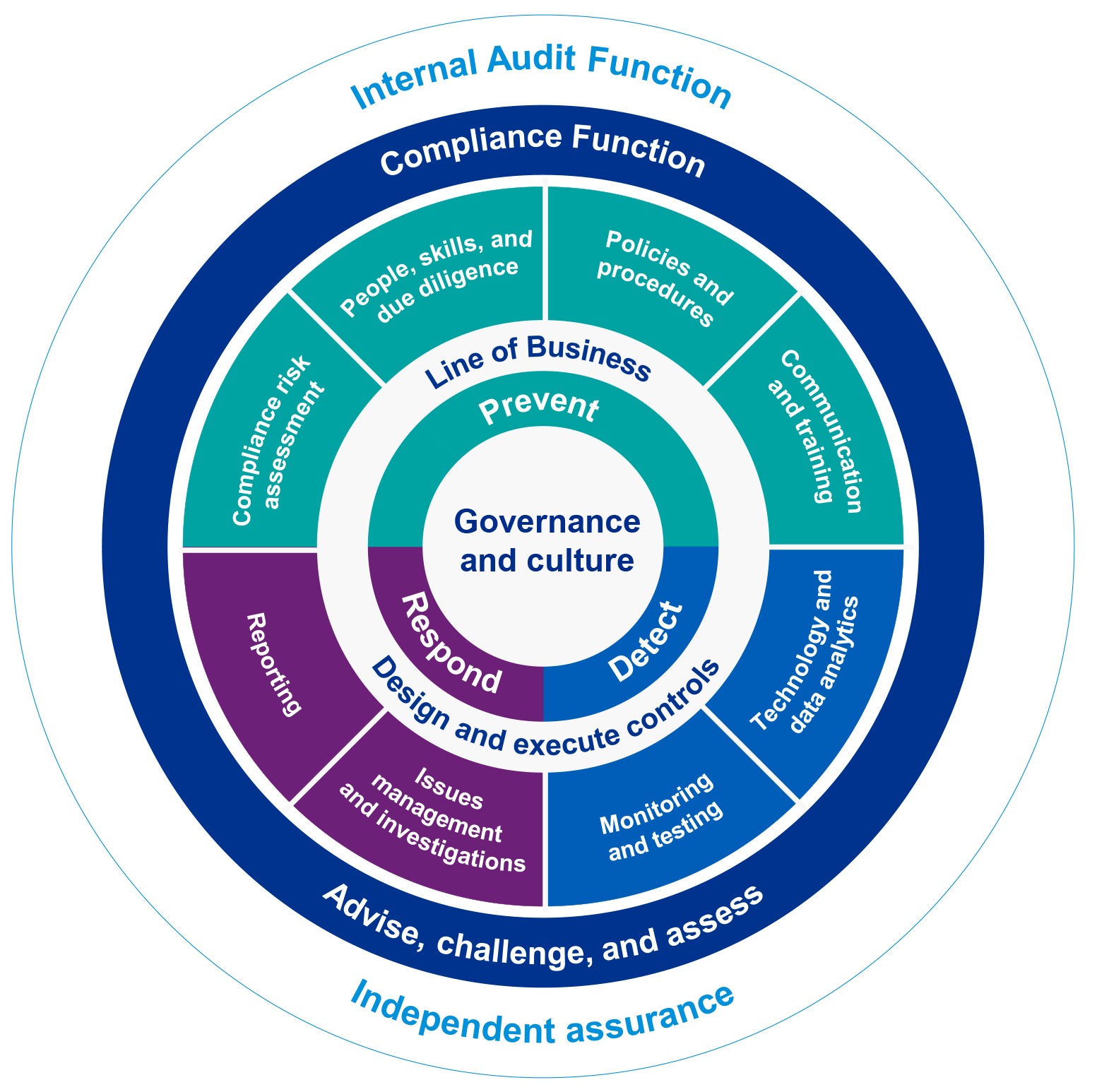

At KPMG, we help organizations enhance compliance, integration and automation for a stronger risk management approach.

In the future, compliance risk management will be more integrated and automated than ever before. Compliance technology solutions are already morphing, seemingly overnight, offering compliance leaders in business, risk and internal audit functions more and more options for automating processes and controls. Regulators around the globe drum the beat for greater integration and operationalization of compliance into business processes and controls, and linkage back to regulatory obligations, as well as more comprehensive metrics to support better compliance risk management. In addition, competition, market conditions and external stakeholders demand greater efficiencies in compliance.

Compliance innovation is now an imperative across all industries, and the time to embark on the journey is now.