Why a better future starts in the past

If your bank is like most, mergers and acquisitions and legacy investments have left you with a patchwork of disjointed systems and applications. Managing this technical debt alongside urgent cost-saving priorities may feel unsurmountable. It doesn’t have to be.

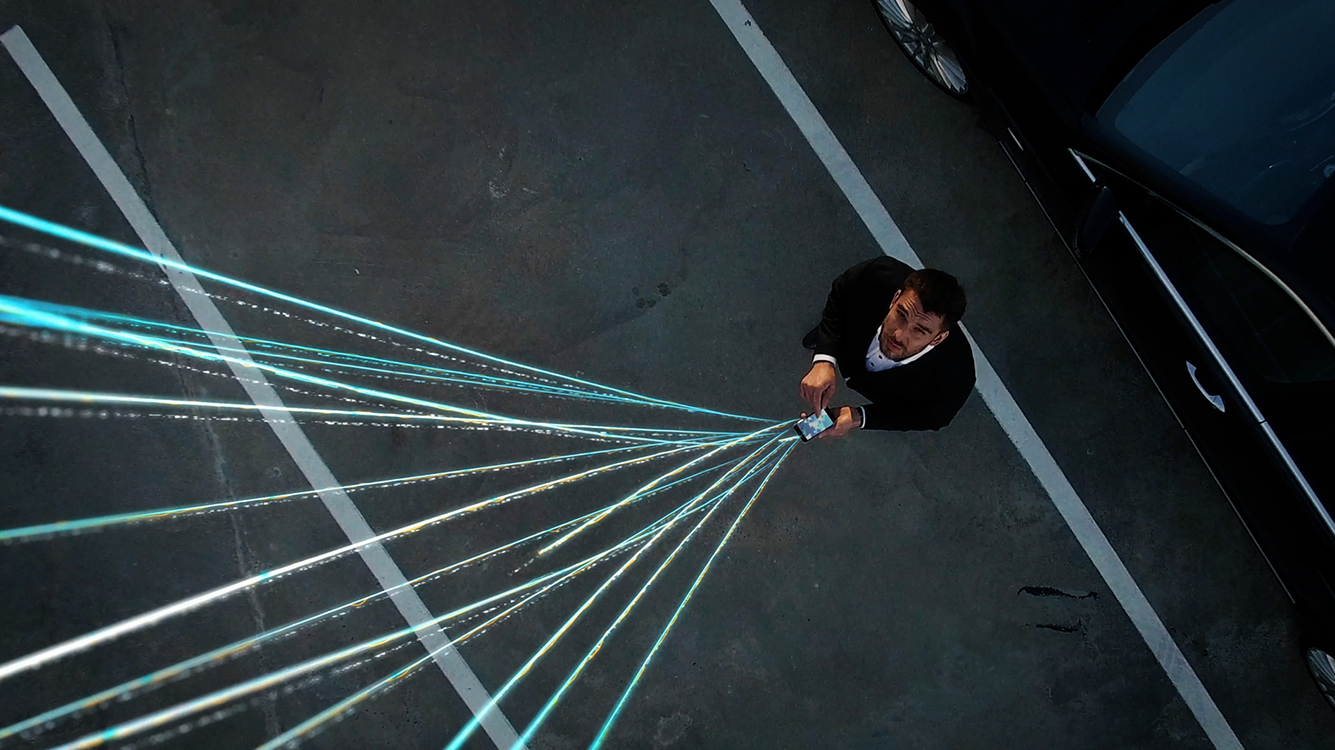

Digitization is the key to unlocking sustainable cost savings and new value. By modernizing and harmonizing the core, banking leaders can do two things at once: reduce costs with process efficiencies AND deliver optimized customer experiences.

This is Connected Enterprise for Banking, and KPMG is here to show you the way.