How to start your transition risk evaluation journey

How banks can measure exposure to transition risk and address data limitations

The global transition to a low-carbon economy poses a substantial threat to carbon-intensive industries and the banks that serve them. Leading financial institutions have begun measuring exposure to transition risk by asking their counterparties to report greenhouse gas (GHG) emissions. Many banks have also turned to proprietary, third-party data sources, but often these data vendors do not provide enough transparency in how they measure carbon emissions.

Measure your exposure to transition risk

Banks should transparently measure their carbon footprint by developing a carbon accounting framework. The total footprint of a financial institution covers all direct and indirect emissions from a bank’s operations. However, Scope 3 Category 15, which includes investment-related emissions through lending and investing in counterparties is shown to have the largest contribution to the overall carbon footprint of these institutions.1 Moreover, financed emissions illustrate the risk of a bank’s counterparties to a potential carbon tax, which would affect their financial stability into the future. Banks can play a vital role in transitioning towards a low-carbon economy through direct investment or lending to more green and sustainable counterparties. Quantifying financed emissions and taking steps to minimize them serve as key first steps.

Address data limitations

Ideally, banks would obtain emissions data for every counterparty to calculate their financed emissions. However, the reports from counterparties are often incomplete or questionable and can frustrate banks’ efforts to accurately measure financed emissions. The Partnership for Carbon Accounting Financials (PCAF) has developed a framework to assist financial institutions in assessing and disclosing the GHG emissions associated with their loans and investments. For example, per U.S. Securities and Exchange Commission (SEC) rules published in March 2021, banks will need to quantify and report emissions for seven GHGs covered by the Kyoto Protocol, including carbon dioxide, methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, sulfur hexafluoride, and nitrogen trifluoride. In addition, energy consumption and production data as well as emissions intensity from bank counterparties are required to accurately estimate financed emissions. While banks can request emissions data from their counterparties, and some counterparties self-report such data, many counterparties still do not measure their emissions. Or there may be issues with the reported data as it might be limited in scope and exclude all upstream and downstream emissions in the supply chain. PCAF recommends that financial institutions use the highest-quality data available for each asset class and improve data quality over time.

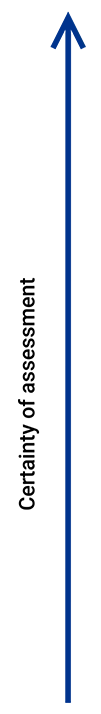

Data availability and certainty of transition risk assessment

It is important to note that there is a correlation between the emissions data level of granularity and transition risk assessment accuracy, which should be considered in counterparties data collection outreach. The table below which is adapted from The Global GHG Accounting and Reporting Standard,1 shows five tiers of data availability for Scores 1–5 financed emissions calculations, along with the data requirements for each score. The certainty of analysis will increase from Score 5 to Score 1. Depending on data availability, a financial institution can move from materiality assessment framework to scenario analysis to stress testing.

Certainty of assessment

| Data quality | Methodology used to estimate the financed emissions | Data requirements |

|---|---|---|

| Score 1 |

Reported emissions

| Counterparty reported (verified or non verified by third party) company-level emissions data |

| Score 2 | Physical activity-based emissions | Counterparty-level outstanding amount |

| Counterparty-level enterprise value (or market cap and total debt) | ||

| Counterparty-level energy consumption | ||

| Emissions factors related to energy consumption | ||

| Score 3 | Physical activity-based emissions | Counterparty-level outstanding amount |

| Counterparty-level enterprise value (or market cap and total debt) | ||

| Counterparty-level production data | ||

| Emissions factor related to production consumption | ||

| Score 4 | Economic activity-based emissions | Counterparty-level outstanding amount |

| Counterparty-level enterprise value (or market cap and total debt) | ||

| Counterparty-level revenue data | ||

| Sector-based emission factor per unit of revenue | ||

| Score 5 |

Asset-based emissions

| Counterparty-level outstanding amount |

| Sector average asset intensity factor |

Explore more

Meet our team