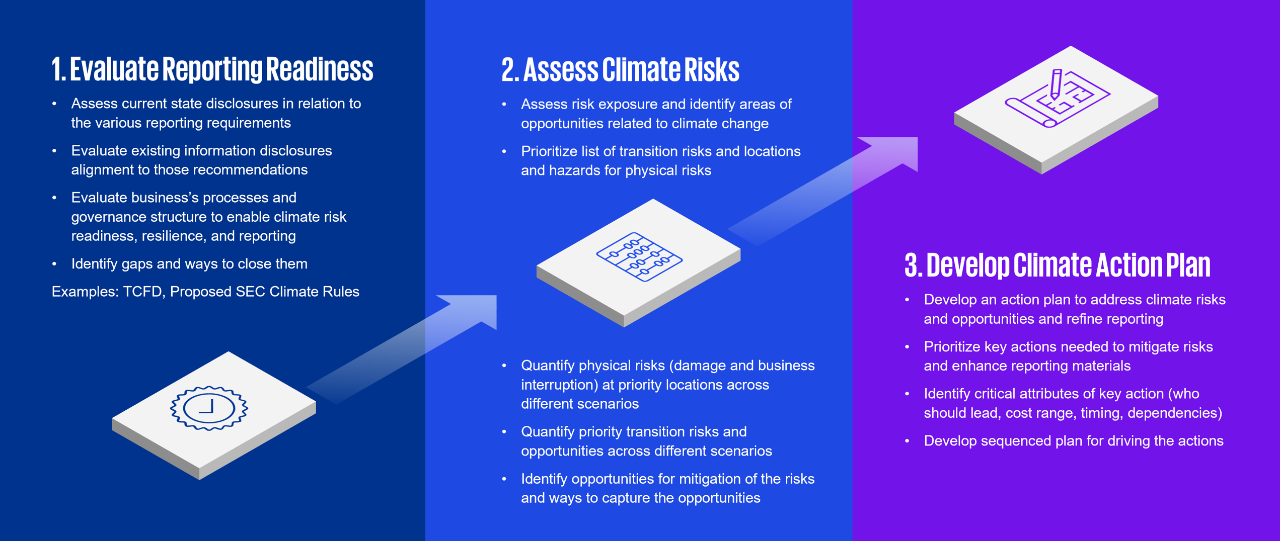

Climate change is reshaping industries. Real assets and infrastructure are threatened by extreme weather. Financial firms face rising loan risks. Energy companies must adapt to a low carbon economy. But challenges like these present opportunities—if companies position themselves to adapt and lead. KPMG provides a comprehensive offering to help companies understand their unique climate risks, harden their organization against risks, and implement a strategy to realize opportunities.

Footnotes

1 Swiss Re Institute, “The economics of climate change: no action not an option” (April, 2021).

2 Bloomberg, “ESG assets may hit $53 trillion by 2025, a third of global AUM" (February 2021)