CCO Insight: Effective Compliance for Sustainability/ESG

Integrating the role of Compliance

How are Chief Ethics and Compliance Officers (CCOs) integrating the role of Compliance in building and sustaining an effective compliance program for Sustainability/ESG (Environmental, Social, and Governance)?

KPMG client CCOs share many key insights, including:

The CCO Role in Sustainability/ESG

- Position Compliance as a coordinator/collaborator with senior leadership and the Board

- Work with internal stakeholders to determine if new Sustainability/ESG controls need to be designed and integrated into an existing framework

- Validate all content messaging, reporting elements, and stakeholder responses prior to issuance

- Use Sustainability/ESG as a value driver for ethical business practices and ‘good corporate citizenship’

Sustainability/ESG Compliance Program

- Determine if a separate Sustainability/ESG policy is appropriate and what it should entail

- Expand third-party and supplier risk management including due diligence and monitoring & testing

- Assess current regulatory change management processes and ensure that they fully capture diverging global, federal, and state Sustainability/ESG

KPMG Perspective

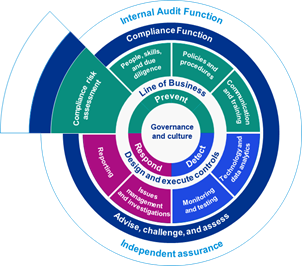

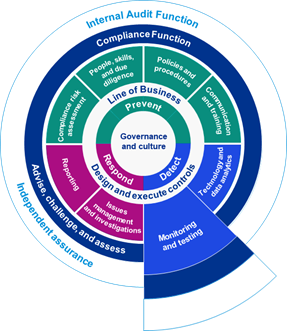

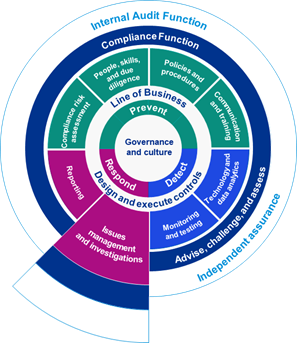

Compliance must drive an effective compliance program for Sustainability/ESG in line with an overall sound framework. This means identifying and building controls to mitigate a new series of potential Sustainability/ESG-related legal, reputational, and compliance risks.

Some key sample questions to ask of your Compliance program include:

Regulatory and Commitment Change Management: Does our regulatory change management process fully capture relevant proposed and new Sustainability/ESG-related requirements at the global, federal, and state levels and identify divergent requirements posing compliance risks?

Risk Assessment: Have we assessed the inherent and residual risks to the ESG-related regulatory requirements/expectations and our company’s Sustainability/ESG-related commitments?

Policies and Procedures: Have we mapped our existing policies and procedures to the Sustainability/ESG-related risks?

Monitoring and Testing: Have we updated our monitoring and testing to the new Sustainability/ESG-related risks (e.g., advertising/marketing/disclosures, social audits, monitoring of third parties/suppliers)?

Issues Management and Investigations: Do our current legacy data access/processes need to be revamped/retooled for active and varied stakeholder Sustainability/ESG-related requests?

Explore more insights

Meet our team

Subscribe to receive Investigations Insider

Helping organizations in their efforts to achieve the highest level of integrity and to manage the cost and risk of litigation, investigations, and regulatory enforcement actions.