Footnotes

- 1 The various accounting rules on the criteria for the accounting acquirer may make the actual determination much more complex. For example, the first step in evaluating the accounting acquirer is to determine whether the entity being legally acquired is a VIE because only the primary beneficiary in a VIE can be considered the accounting acquirer. See Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 805, Business Combinations (ASC 805) and FASB ASC Topic 810, Consolidation (ASC 810).

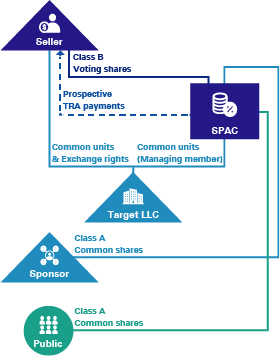

- 2 The target company frequently would be akin to a limited partnership if it is managed by a sole general partner or managing member (the SPAC), which would cause it to be a VIE. If the target company is structured to be more akin to a corporate form, the target company would not likely be a VIE.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.