Usually a discussion about standard setting is based on where a company has reporting obligations, and for dual preparers that means a discussion about IFRS Standards versus US GAAP. However, ESG reporting is different. Yes, one aspect is about reporting obligations; a company listed in both the EU and the US will be concerned about the potential need to collect and report two different sets of ESG metrics.

But ESG reporting goes beyond a company’s traditional financial reporting boundaries and obligations. As companies seek to establish their ESG strategies and report robust and timely metrics, they are increasingly seeking assurance along all elements of their supply chain and into their customer base. While not the only factor, a fractured landscape of reporting requirements adds to the uncertainty as companies seek clarity about what is expected of them.

Existing ESG reporting frameworks or standards have been developed largely independently – some designed for the benefit of investors and some designed for a broader group of stakeholders. The related organizations increasingly recognize the need to work together for a common purpose. For example, leading global ESG reporting organizations have published a prototype for an approach to climate-related disclosures1, and the US-based Sustainability Accounting Standards Board has merged with the International Integrated Reporting Council with the intent of simplifying the corporate reporting system.

While we welcome all efforts aimed at closer cooperation between organizations that would reduce diversity in reporting, we believe that a codified effort under the umbrella of a single standard setter would achieve a faster and more consistent reporting baseline. This is why the IFRS Foundation’s initiative to create a new International Sustainability Standards Board is so relevant.

About the International Sustainability Standards Board

The proposed ISSB would be based on the following principles.

- Investor focus. Standards would be designed to provide decision-useful information for investors and capital markets, and not broader stakeholders (e.g. customers, employees, local communities).

- Climate first. Working within a broader sustainability remit, the ISSB’s initial focus would be climate-related disclosures.

- Building on existing frameworks. The ISSB would seek to build on the mature work already done by leading ESG organizations. In particular, the ISSB would consider the work of the Task Force on Climate-related Financial Disclosures (TCFD) in developing proposals related to climate; a working group is currently looking at further developing the climate prototype published by leading global ESG reporting organizations.1

- Building blocks approach. The objective of the IFRS Foundation Trustees is for the ISSB to develop “a globally consistent and comparable sustainability reporting baseline, while also providing flexibility for coordination on reporting requirements that capture wider sustainability impacts.” This approach would allow national and regional jurisdictions to build on that global baseline to set supplemental standards that serve their specific jurisdictional needs.

The proposals have received widespread support, including from the Financial Stability Board, G20 Finance Ministers and Central Bank Governors, and the International Organization of Securities Commissions.

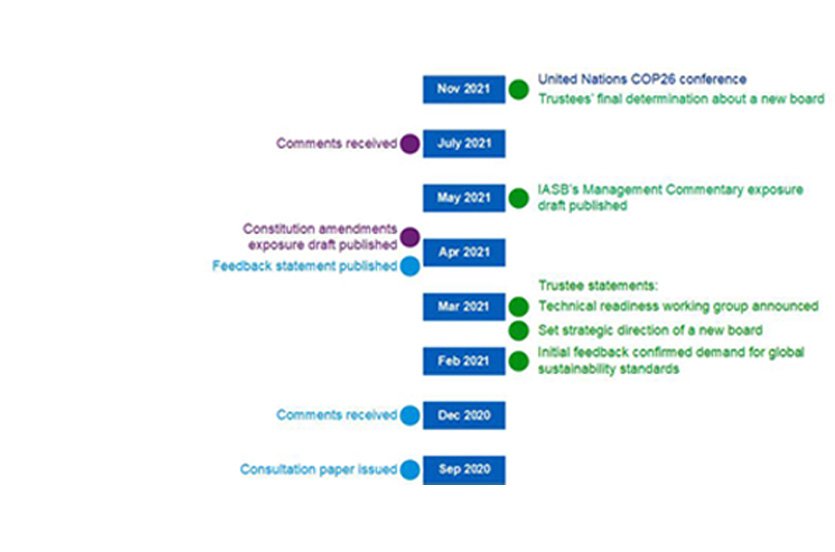

The last step in the process to facilitate formation of the ISSB is changing the IFRS Foundation’s constitution; the comment period on proposed amendments closed at the end of July. Following finalization of those amendments, the creation of the ISSB is expected to be announced ahead of the UN Climate Change Conference (COP26) in November.