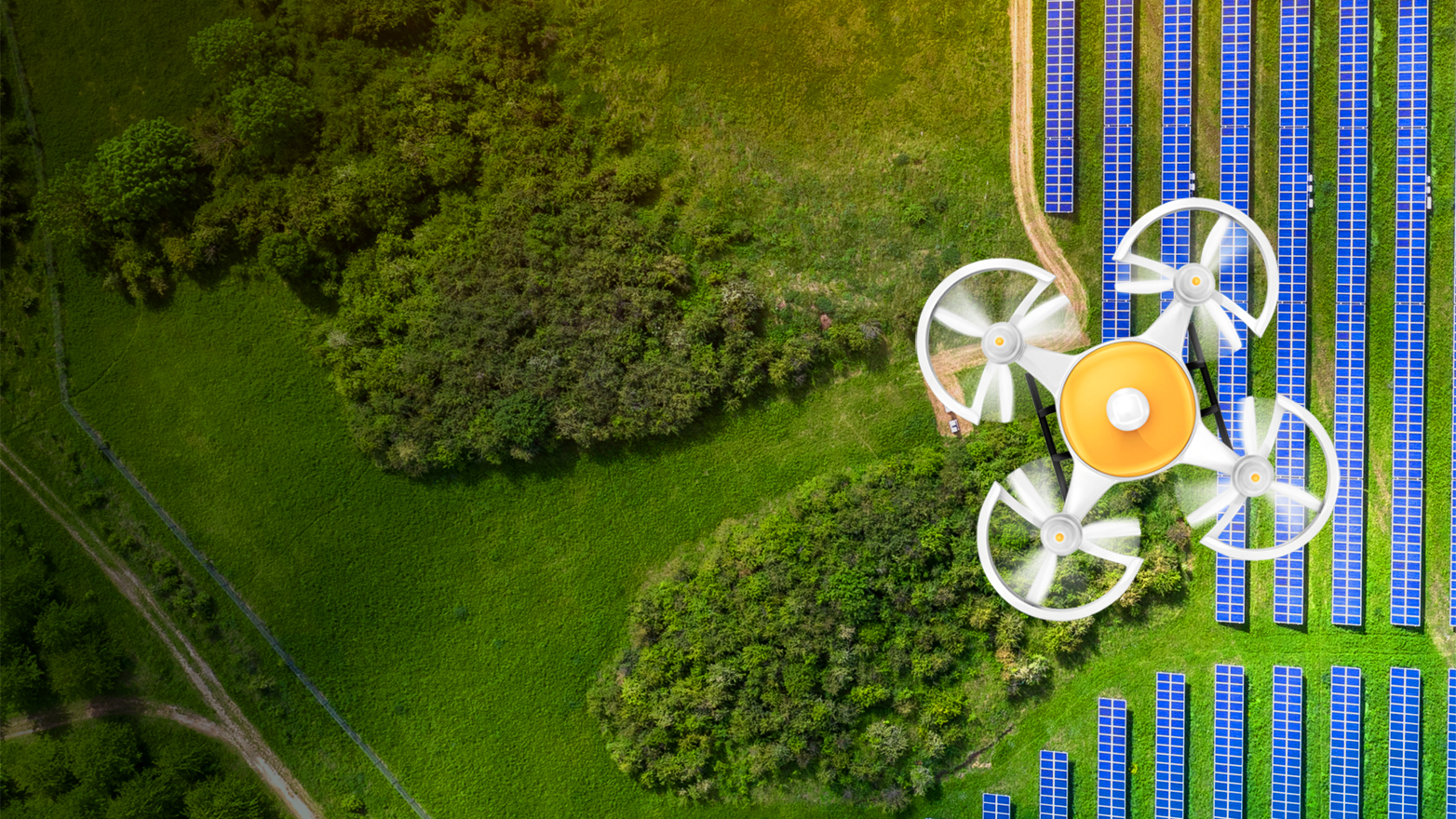

Climate accounting your stakeholders want to see

Understand the growing link between environmental and financial performance

KPMG is pleased to bring you a new patent-pending blockchain-based capability, Climate Accounting Infrastructure, which is intended to help organizations more accurately measure their greenhouse gas emissions. The capability will also analyze climate risks associated with asset valuations, and help organizations better assess and employ systems to offset their emissions.

Featured videos

See how KPMG Climate Accounting Infrastructure helps the oil & gas and enterprise real estate industries on their path to NetZero

Oil and Gas

Enterprise Real Estate

With organizations expected to document their sustainability practices and results to demonstrate alignment with environmental, social and corporate governance (ESG) demands of capital markets investors, as well as compliance with regulatory requirements, they need a trusted and transparent system to corroborate their legacy measurements and reporting.

This capability will use blockchain to securely store environmental data in a financial system as part of organizations’ climate risk assessments and asset valuations, including as part of their real estate portfolios. It is also intended to help organizations build sustainable, long term financial and business strategies and aid with overall business forecasting.

To help accurately measure greenhouse gas emissions, the capability will analyze massive amounts of structured and unstructured environmental data, secure that data on a blockchain, and use machine learning and other AI strategies to perform risk modeling and reconcile across data sources. Organizations and their stakeholders will be able to verify data cryptographically, in real time.

Trusted capabilities, such as Climate Accounting Infrastructure, will be critical to meet stakeholder expectations and to comply with emerging regulations.

Arun Ghosh

KPMG’s U.S. Blockchain leader

Dive into our thinking:

Climate accounting your stakeholders want to see

Download PDFExplore more

Meet our team