Taking a fresh look at the technology risk operating model

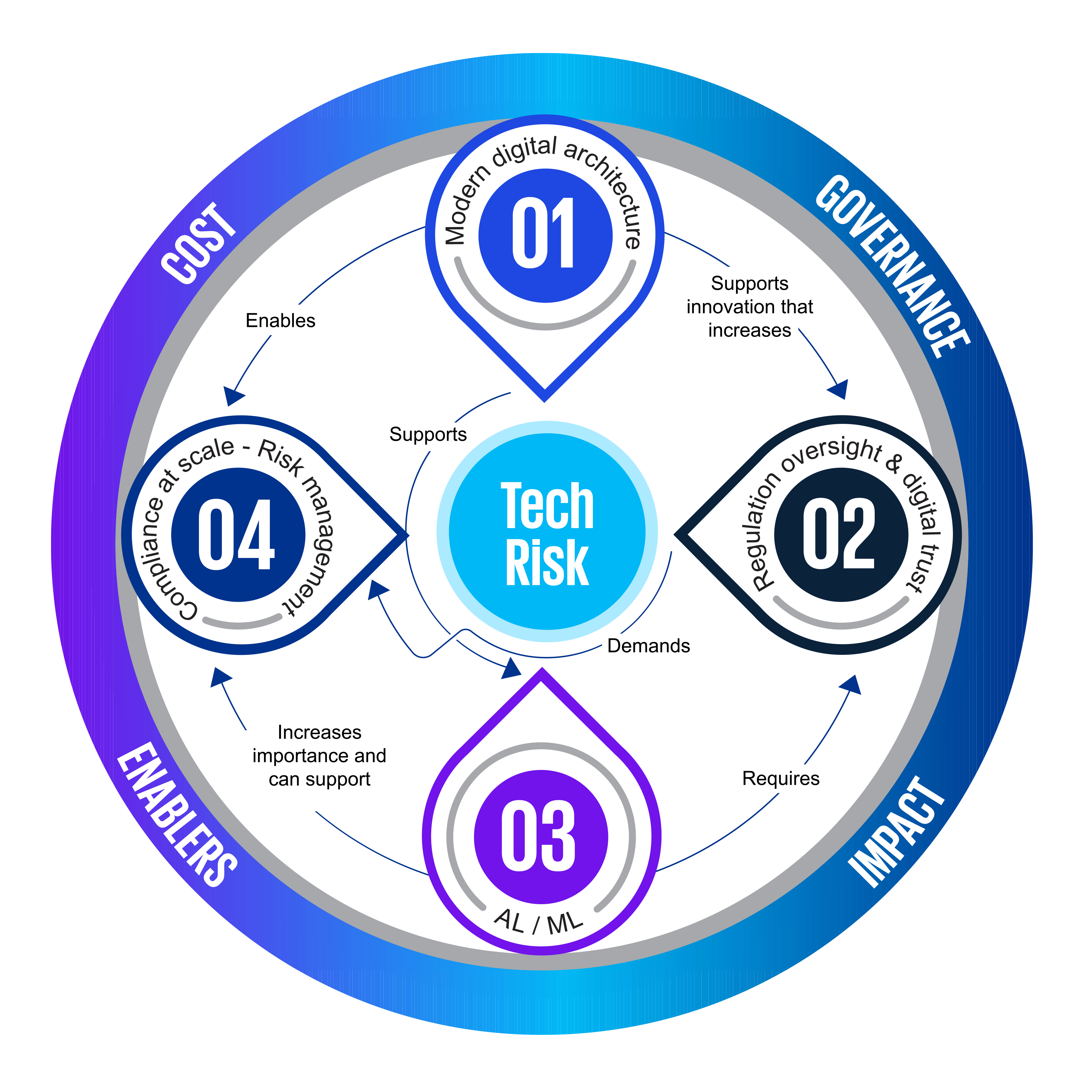

Due to emerging technology risk and regulatory and governmental compliance mandates, large organizations require a holistic risk approach that accelerates strategic value realization and competitive advantage. The goal is an operational risk model built for the accelerated rate of technology change that addresses an organization’s appetite for risk while offering increased opportunities for value creation.

| 72 percent of respondents in the 2022 KPMG CEO Outlook Survey agreed that they have an aggressive digital investment strategy, intended to secure first-mover or fast-follower status. |