Footnotes

2 IFRS 9, Financial Instruments

Understanding the guidance in IFRS 16 on accounting for lease modifications by both lessees and lessors.

From the IFRS Institute – August 30, 2019

Companies have been busy implementing the new leases standard (IFRS 16), with a particular focus on transition and the Day 1 accounting. Although companies may have dealt with lease modifications at transition, modifications that take place after transition are a key ‘Day 2’ aspect of the new standard for both lessees and lessors. Lease modifications are common and accounting for them can be complicated. In this article, we outline the lease modification guidance in IFRS 16, compare it to US GAAP, and describe the lessee and lessor accounting for common types of lease modifications.

IFRS 16 defines a lease modification as “a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease.” A lease modification results from renegotiations between the lessee and lessor. Example lease modifications include (but are not limited to):

Often, more than one modification will occur simultaneously – e.g. reducing building space subject to a lease, while simultaneously extending the term of the lease for the remaining space. Lease modifications are defined similarly under US GAAP.1

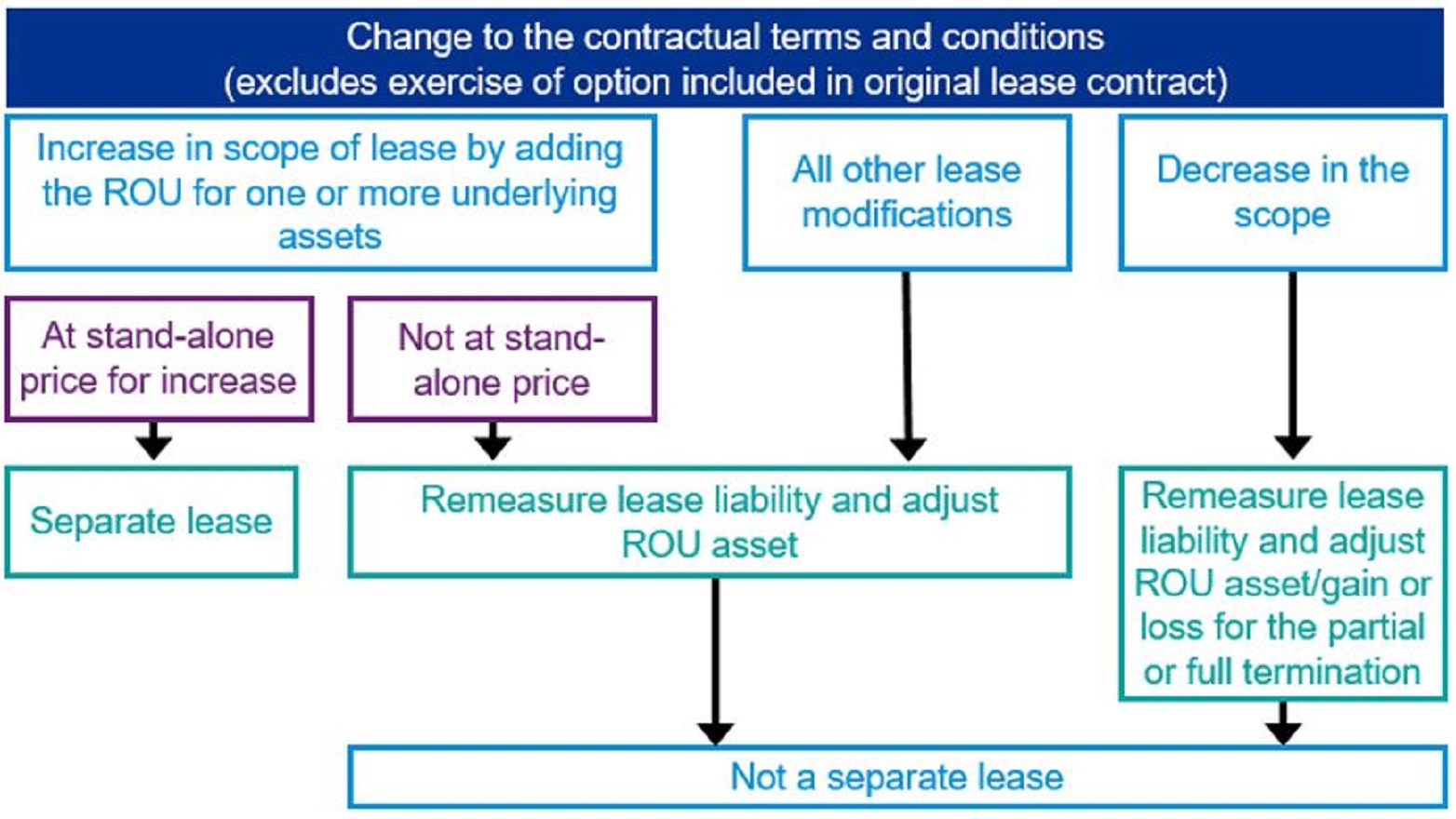

The starting point for a lease modification is to assess whether it creates a separate lease. A lessee accounts for a lease modification as a separate lease if both of the following conditions exist:

A modification that only increases the lease term on the existing underlying asset(s) does not meet the first condition because it does not grant the lessee the right to use one or more additional underlying assets.

Example – Increase in scope with corresponding increase in consideration Lessee LE entered into a lease with Lessor LR to lease one floor in an office building for 10 years. LE’s business has since expanded and LE now requires additional office space. At the beginning of Year 6, LE and LR agree to amend the contract to grant LE the right to use an additional floor of office space in the same building for 5 years. The lease payments for the additional office space are $100,000 per year, which is commensurate with the market rental price for similar office space. The lease of the additional office space was not part of the original terms and conditions of the contract. Therefore, this is a lease modification. This modification increases the scope because it grants LE the right to use an additional floor of office space. Because the lease payments for the additional right of use are commensurate with the market rental price for similar office space leases (i.e. equivalent to the stand-alone price for the increase in scope), LE accounts for this modification as a separate lease. In a different scenario, assume that the annual lease payments remained unchanged from the original lease or were increased by an amount that was not commensurate with the stand-alone price for the additional office space (e.g. $50,000 per year). In those cases, the modification would not be accounted for as a separate lease. |

Separate lease

If a lease modification creates a separate lease, the lessee makes no adjustments to the original lease and accounts for the separate lease the same as any new lease.

Not a separate lease

For a modification that is not a separate lease, the lessee’s accounting depends on the nature of the modification.

| Type of lease modification | Lessee accounting |

| Decrease in scope and change in consideration | Step 1. Decrease the lease liability and right-of-use (ROU) asset in proportion to the decrease in scope. Recognize a gain or loss for the difference between the (1) change in the lease liability and (2) change in the ROU asset. Step 2. Remeasure the lease liability to reflect the modified terms, using a revised discount rate determined at the modification date. Recognize the corresponding adjustment to the ROU asset. |

| All other modifications | Remeasure the lease liability to reflect the modified terms using a revised discount rate determined at the modification date. Recognize the corresponding adjustment to the ROU asset. |

Comparison to US GAAP Lessee accounting for lease modifications under US GAAP is the same as under IFRS 16. However, differences in the accounting for a lease both pre- and post-modification arise because of the differences between the single IFRS 16 and dual US GAAP lessee accounting models. For example, the accounting for the same lease and the same modification to that lease can differ if the lease is classified as an operating lease under US GAAP before and/or after the modification. |

Example – Modification that decreases scope Original lease terms

At lease commencement, LE records an ROU asset and lease liability of $386,087, which is the present value of the 10 annual payments of $50,000 using the 5% incremental borrowing rate. Lease modification

At the beginning of Year 4, prior to the modification, the carrying amounts of the ROU asset and lease liability are $270,261 and $289,319, respectively. Lessee accounting LE first decreases the lease liability and ROU asset in proportion to the decrease in scope. The decrease in scope was 2,000 sq. ft. or 40% of the original 5,000 sq. ft. office space. Therefore, LE decreases both the ROU asset and lease liability by 40%. As a result, the remaining ROU asset is $162,156 (a decrease of $108,105), and the remaining lease liability is $173,591 (a decrease of $115,728). LE recognizes the difference between the decrease in the ROU asset and the decrease in the lease liability of $7,623 ($115,728 – $108,105) as a gain in profit or loss at the effective date of the modification. LE then remeasures the lease liability to reflect the revised lease payments of $30,000 annually for the remaining lease term of 7 years, using the revised incremental borrowing rate of 7%. As a result, the modified lease liability is $161,679, a further decrease of $11,912 ($173,591 – $161,679). LE recognizes the $11,912 decrease to the lease liability with a corresponding decrease to the ROU asset. |

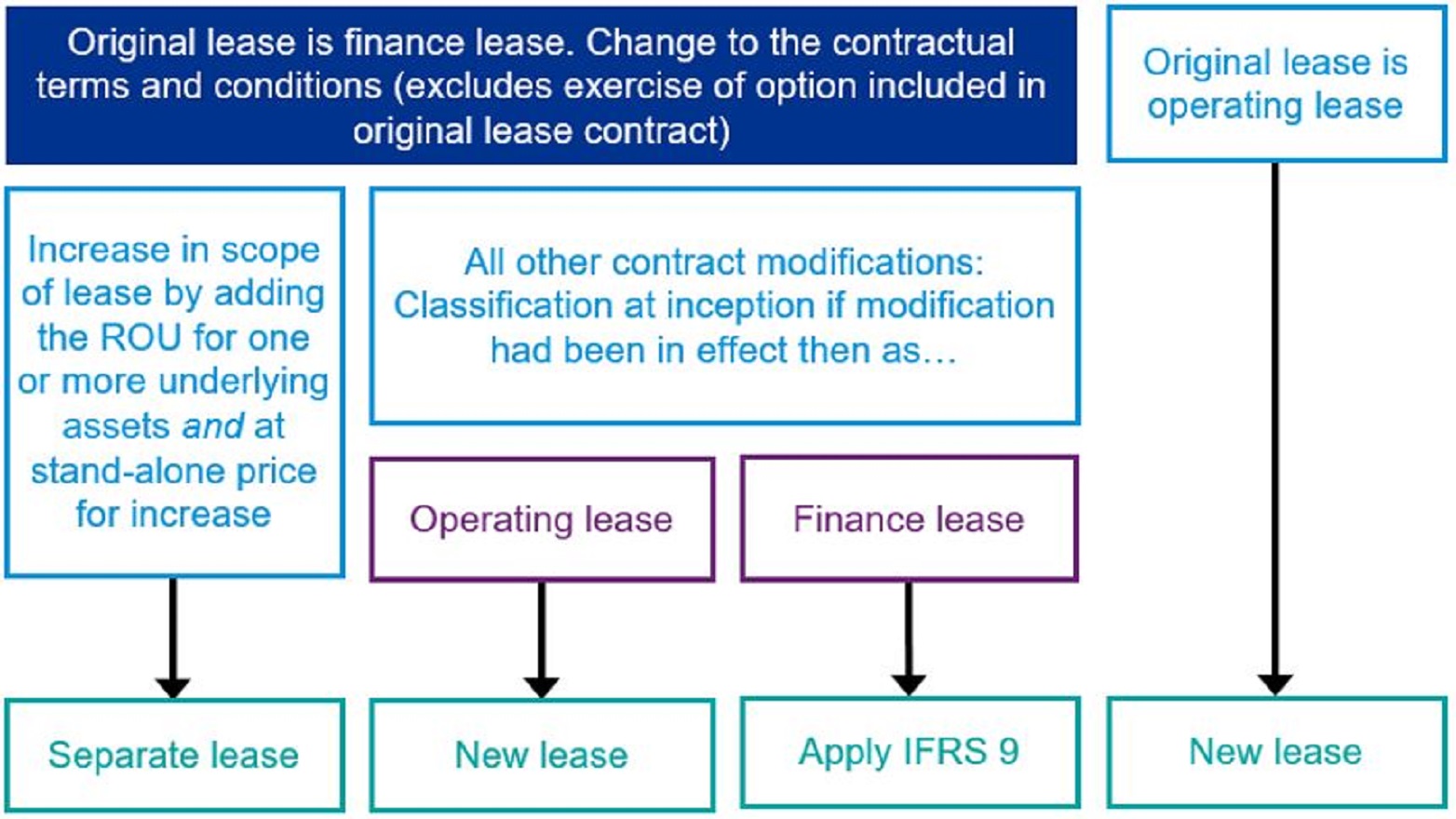

Lessor accounting for lease modifications depends on the classification of the lease prior to the modification.

Operating lease modifications

If the original lease is an operating lease, the lessor accounts for the modification as a new lease from the effective date of the modification, including any prepaid or accrued lease payments relating to the original lease in the lease payments for the new lease.

Comparison to US GAAP Under US GAAP, a lessor first evaluates whether the modification of an operating lease should be accounted for as a separate contract applying the same criteria as lessees do. If the modification does not meet the criteria to be accounted for as a separate contract, a lessor accounts for the modification as if the original lease had been terminated and a new lease commenced on the effective date of the modification, like IFRS 16. If the modification meets the criteria to be accounted for as a separate contract, the modification is accounted for as a separate contract, unlike IFRS 16. |

Finance lease modifications

If the original lease is a finance lease, the lessor needs to assess whether the modification creates a separate lease using the same criteria as lessees.

Separate lease

If the lease modification creates a separate lease, the lessor makes no adjustment to the original lease and accounts for the separate lease the same as any new lease.

Not a separate lease

If the lease modification does not create a separate lease, the accounting depends on how the lease would have been classified had the modified terms been in effect at the inception date.

| Classification based on modified terms | Lessor accounting |

| Operating | Account for the lease modification as a termination of the original lease and creation of a new lease from the effective date of the modification. Measure the carrying amount of the underlying asset as the net investment in the original lease immediately before the effective date of the modification. |

| Finance | Apply the requirements of IFRS 92 to determine whether the modification is substantial – i.e. whether the cash flows of the original financial asset and the modified or replacement financial asset are substantially different. The following applies under IFRS 9:

|

Comparison to US GAAP Like IFRS 16, a lessor in a sales-type or direct financing lease accounts for a lease modification as a separate contract if the same criteria used by lessees to make this assessment are met. If the modification is not a separate contract, the lessor reassesses the classification of the lease based on the modified terms. However, unlike IFRS 16 where the lessor first assesses whether the classification of the lease would have been different if the modified terms had been in effect at the inception date, classification of the modified lease is assessed as of the modification effective date. Also, because of the different lease classifications available under US GAAP (i.e. sales-type and direct financing), there are other differences in post-modification lessor accounting when lease modifications are not accounted for as separate contracts.

|

The subsequent accounting for leases is just as important as the Day 1 accounting and could be significantly impacted by lease modifications. Therefore, companies should not be taking a “set it and forget it” approach when it comes to lease accounting. Instead, companies need to ensure they have processes and controls that enable them to identify and account for lease modifications completely and in a timely manner.

This may require companies to monitor correspondence with lease counterparties, internal approvals of contract modifications and other means by which modifications can be affected. These processes and controls will likely need to involve individuals from different functions within the organization, such as accounting, legal, procurement and sales.

As we discuss in our article on lessons learned from the implementation of IFRS 16, implementation efforts require significant coordination, communication and collaboration across the organization.

More resources

|

CPE seminars and customized training

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.