New definition of a business: IFRS compared to US GAAP

The new IFRS definition of a business could change when a transaction is an acquisition of assets or a business combination.

From the IFRS Institute - Nov 15, 2018

The IASB has amended its definition of a business. We expect the new definition will be especially helpful in sectors such as financial institutions, pharmaceuticals, technology and real estate, with more transactions accounted for as an acquisition of assets. One of the key changes is the introduction of an optional concentration test that simplifies the assessment and allows a company to conclude the acquired set is not a business. The FASB has already introduced similar changes. This article touches on the key changes from the previous definition, its practical application and the remaining differences between IFRS and US GAAP.

Why the change?

The IASB’s post-implementation review of IFRS 3[1] highlighted that companies encounter difficulties when applying the legacy definition of a business. This is due to the lack of practical implementation guidance. It also indicated that the definition may have been capturing a broader range of transactions under US GAAP than the identical definition in IFRS 3. Because there are fundamental differences in the accounting for an acquisition of assets versus a business combination, appropriate application of the definition is critical. The IASB has responded to these concerns by narrowing the definition and clarifying its application.

The FASB also conducted a post-implementation review of its equivalent standard.[2] At the time of this review, the definition of a business under IFRS and US GAAP were identical, and the FASB received similar feedback and concerns. This resulted in the FASB issuing ASU 2017-01.[3]

While slight differences remain (the most significant being an optional concentration test that is mandatory under US GAAP), the amended IFRS and US GAAP definitions are substantially converged. The IASB’s objective with this amendment was for more consistency in the application of the definition for both companies using US GAAP and companies using IFRS.

Business combination vs. asset acquisition: what’s the big deal?

The accounting for an asset (or group of assets) acquisition differs significantly from that of a business combination. Here we summarize some of those differences.

| Business combination | Asset acquisition |

|---|---|

| Applicable guidance | |

| IFRS 3 | Other standards as relevant to each asset acquired or liability assumed - e.g. the acquisition of a building is accounted for under IAS 16(4) |

| Initial measurement | |

| Identifiable assets and liabilities assumed are generally measured at fair value. Goodwill or a bargain purchase gain is recognized for any difference between the consideration paid and the recognized amounts of identifiable items. | Purchase price is allocated to the identifiable assets and liabilities assumed on a relative fair value basis; as an exception, financial assets and liabilities are measured at their transaction price (fair value). No goodwill or a bargain purchase gain is recognized. |

| Direct acquisition-related costs | |

| Expense as incurred. | Depends on the nature of the acquired assets. Often included in the cost basis of the acquired assets. |

| Contingent consideration | |

| Recognize at the acquisition date and measure at fair value. Subsequent changes to the fair value of liability-classified contingent consideration are recognized in profit or loss. | No explicit guidance, and there is diversity in practice. Judgment is required when determining what standard to apply - e.g. IAS 16 or IAS 37[5] on initial recognition and initial and subsequent measurement. Any additional payment(s) may be expensed as incurred or the cost basis adjusted depending on circumstances. |

| Deferred taxes | |

| Recognize when the tax basis of assets acquired and liabilities assumed differs from their accounting basis. | Generally not recognized, except for acquired tax credits or tax losses. |

| Measurement period | |

| Up to one year post acquisition date to finalize the measurement of assets acquired and liabilities assumed. | Measurement is completed at the acquisition date. |

The definition of a business is narrowed and clarified

The amendments to IFRS 3 redefine a business as “an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.”

The amended definition is still based on three pillars – inputs, processes and outputs – but it results in a number of key changes. While some are more significant than others, each play a key role in the IASB’s objective of having more consistency in applying the definition.

New definition | Old definition |

|---|---|

| Definition of outputs | |

| The concept of outputs focuses on goods or services to customers. | The concept of outputs also captured lower costs. This was not helpful to distinguish between assets and businesses because often assets, for example equipment, are acquired to lower costs. |

| Missing inputs or processes | |

| A set of activities and assets (set) must include at a minimum an input and a substantive process to be a business. | A set was a business even if it missed inputs or processes, as long as a market participant could continue to operate the set as a business by integrating it with its own inputs and processes. For example, a loan or investment property portfolio could be a business even if sold without the asset management function, because a market participant could provide that function. |

| Substantive process | |

| The acquired process must be substantive. Guidance is provided and depends on whether the set has outputs. | No similar guidance. It was difficult to assess if an acquired process was sufficient for a set to operate as a business. |

| Workforce | |

| The presence of an organized workforce that meets certain criteria is an indicator of a substantive process. An acquired outsourcing agreement may give access to an organized workforce. | The presence of employees was generally an indicator that a business exists, especially when there were no outputs – e.g. an activity in development stage. Outsourcing arrangements were not considered. |

| Presence of goodwill | |

| Not a determinative indicator. | Presumption that the set was a business. |

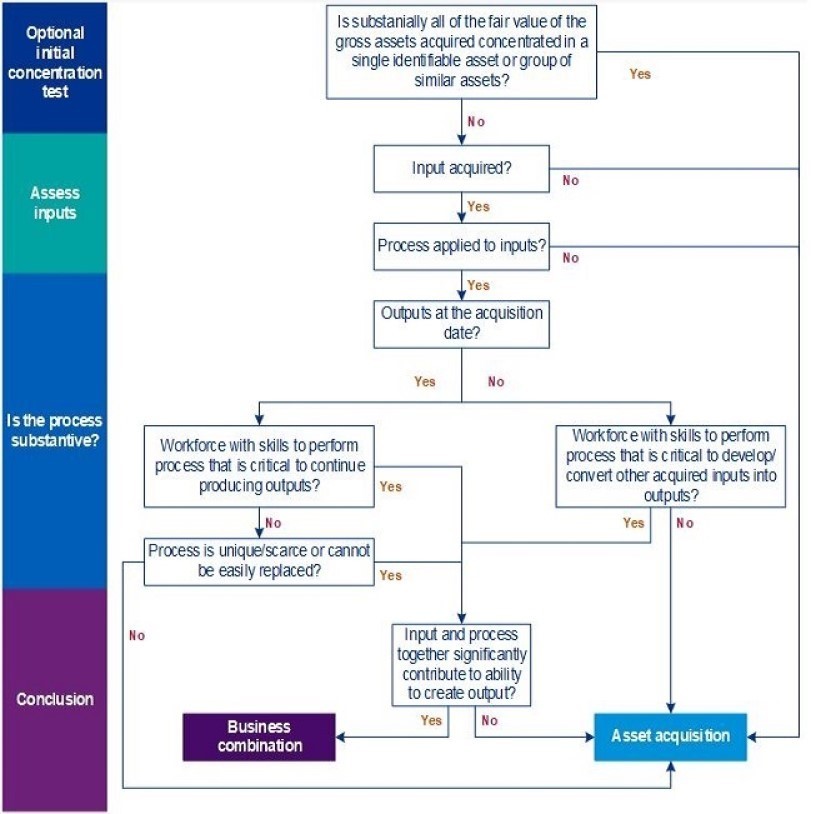

In addition to these changes, the amended definition of a business provides detailed examples to assist with the interpretation of what’s considered a business. We’ve outlined the detailed steps as follows:

Application of the new optional concentration test

The introduction of the optional concentration test is a fundamental change in the amended definition and can be applied on a transaction-by-transaction basis. The IASB intended this concentration test to simplify the determination that a set does not meet the definition of a business, which would reduce costs and complexities by avoiding the requirement to perform a detailed assessment. Specifically, when substantially all of the fair value of the assets acquired is concentrated in a single asset or a group of similar assets, the set is not a business.

If the initial concentration test is not met, or a company elects to bypass this step, an assessment focusing on the existence of inputs and a substantive process is required.

Although substantially converged, one of the key differences between the IFRS and US GAAP amended definitions is that this initial concentration (or screen) test is mandatory under US GAAP. The IASB however believes the same outcome (whether a transaction is an acquisition of assets versus a business combination) will be achieved regardless of whether the initial concentration test is performed.

Although applying the new definition still requires judgment, the use of the initial concentration test may reduce both the cost and effort when a transaction clearly is not a business – i.e. substantially all of the fair value is concentrated in a single asset or a group of similar assets.

What to expect

The amended definition of a business could mean that more transactions are acquisitions of assets under IFRS, with the following consequences.

- Transactions less dilutive to earnings in the year of acquisition, because of fewer transaction costs being expensed.

- Future earnings less volatile, because of the possible shift in values from goodwill to depreciable assets. Levels of depreciation and amortization expense post acquisition may increase to the benefit of less impairment exposure on goodwill.

- Greater diversity in practice when recognizing contingent consideration, because there’s no explicit guidance in IFRS and judgment applies.

- Effective tax rate more volatile, because of fewer deferred taxes being recognized.

- Operational challenges, especially with deals closed near the reporting date, because of less time to finalize measurement and purchase price adjustments.

The amended definition also involves new judgments in an area that has long been challenging, in particular for sectors such as financial institutions, pharmaceuticals, technology and real estate. Although the amended definition provides a clearer path to determine the appropriate accounting model, significant judgment remains when determining:

- what is part of the set when not specifically identified in the purchase contract;

- if single assets within a major asset class have different risk characteristics; and

- whether an acquired workforce is performing a critical process.

Companies should continue paying close attention to the details of the underlying transaction when applying the amended definition; appropriate application of the new framework remains critical in determining the appropriate accounting model. The amendments to IFRS 3 apply to transactions for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after January 1, 2020 with early application permitted.

Comparison with US GAAP Definition of output

Minimum requirements to be a business

The concentration test

Guidance on the substantive process

Goodwill

|

- IFRS 3, Business Combinations

- FASB Statement 141(R), Business Combinations, the legacy standard now codified as ASC 805, Business Combinations

- ASU 2017-01, Clarifying the Definition of a Business, is effective for public business entities for annual and interim periods in fiscal years beginning after December 15, 2017. For all other entities, it is effective for annual periods in fiscal years beginning after December 15, 2018, and interim periods in fiscal years beginning after December 15, 2019. A company can early adopt the ASU and apply it to transactions that have not yet been reported in financial statements that have been issued or made available for issuance.

- IAS 16, Property, Plant and Equipment

- IAS 37, Provisions, Contingent Liabilities and Contingent Assets

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation.

KPMG Executive Education

CPE seminars and customized training

Explore more

Meet our team

Subscribe to the IFRS® Perspectives Newsletter

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.