Financial institutions are adapting to a host of advanced technologies which are fundamentally changing their analytics landscape. They are also faced with unprecedented regulations guiding the usage and control of data and models used for analytics. At the same time, cost pressures are driving a need for targeted spend and increasing efficiency in both the deployment and the usage of models, with significant data dependencies.

While organizations are faced with these challenges, they must strike a balance between commercial needs, risks to the organization, regulatory requirements, and implementation costs. KPMG has helped our clients address this need over time, and our Modeling and Analytics services have been specifically developed to help our clients:

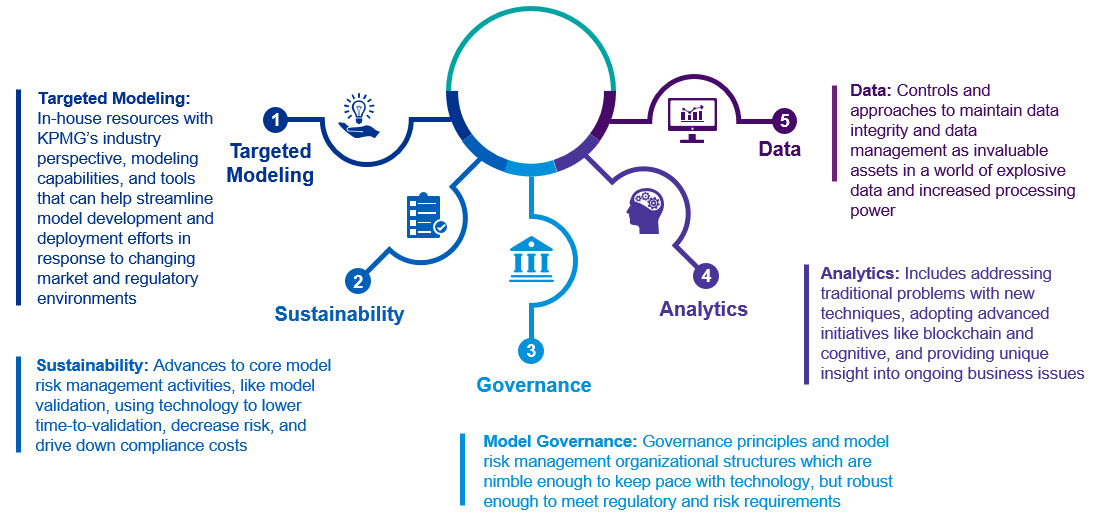

- Build targeted models for meeting both strategic and regulatory needs;

- Create a sustainable and cost-effective approach to model validation and model risk management regulatory compliance;

- Establish a global resource model to supplement a bank’s internal quantitative modeling and development teams on a long-term basis

- Establish governance structures and ensure scalability which are nimble enough to keep pace with technology, but robust enough to meet our regulator’s goals;

- Develop advanced analytics for solving new problems and supporting advanced initiatives like digital labor and cognitive; and

- Maintain data integrity and effective data management throughout the modeling life cycle