IFRS adoption in Japan will affect US subsidiaries

Historically, Japanese Foreign Private Issuers (FPIs) have used US GAAP or JGAAP with a reconciliation to US GAAP. However, over the years IFRS has slowly but surely gained momentum in Japan.

From the IFRS Institute - February 2017

Japanese companies with overseas subsidiaries can choose from US GAAP, IFRS as issued by the IASB, Japan’s Modified International Standards (endorsed version of IFRS), and Japanese GAAP (JGAAP). Historically, Japanese Foreign Private Issuers (FPIs) have used US GAAP or JGAAP with a reconciliation to US GAAP. However, over the years IFRS has slowly but surely gained momentum in Japan.

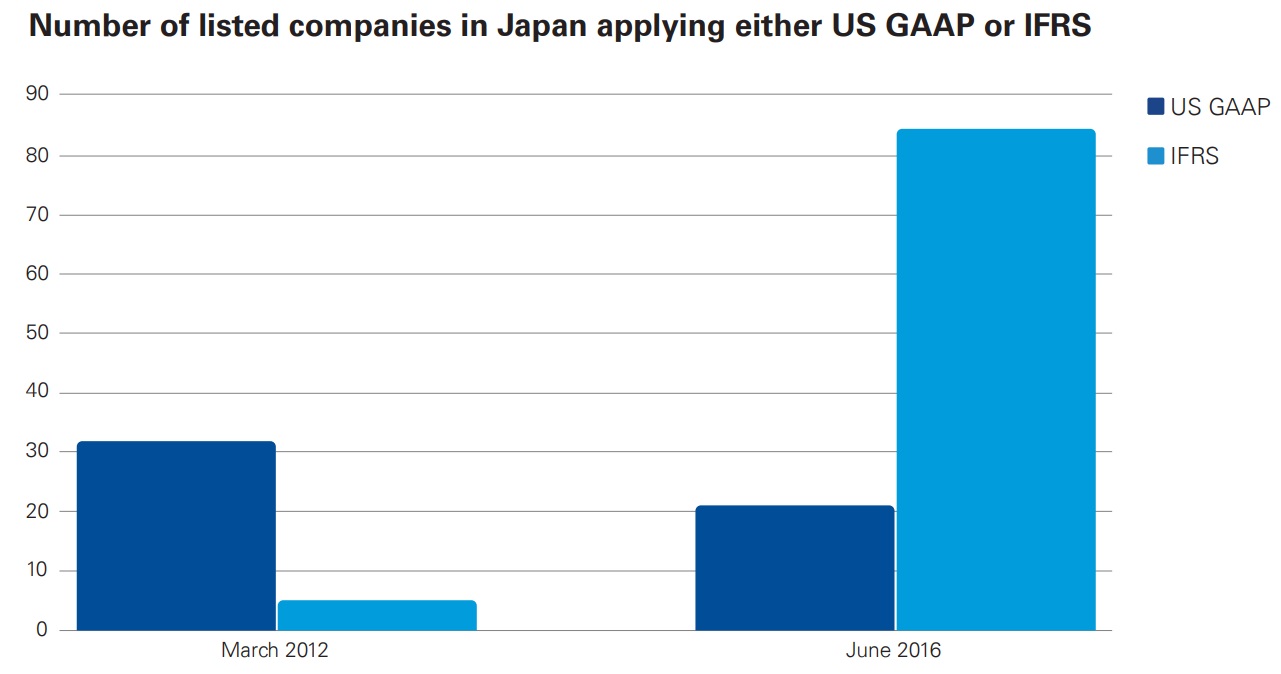

The Financial Services Agency (FSA), the Japanese financial regulatory body, has allowed Japan’s listed companies to use IFRS since 2010. In 2013, the FSA eased regulations for applying IFRS. As a result, the number of companies that either have applied or have decided to apply IFRS has increased significantly. As of February 2017, there are 133 such companies – representing 4% of listed companies, but approximately 25% of the listed market capitalization in Japan. We expect this trend will continue in the coming years.

In contrast, the number of Japanese companies applying US GAAP has been decreasing.

This trend has direct consequences for US subsidiaries of Japanese groups. JGAAP allows companies to consolidate their subsidiaries using their financial statements prepared under US GAAP or IFRS, with a few adjustments. Therefore, US subsidiaries of Japanese groups have often been reporting under US GAAP whether the group was a JGAAP or US GAAP preparer. There is no such permission under IFRS. Therefore, as Japanese groups adopt IFRS, their US subsidiaries will also need to convert to IFRS for consolidation purposes.

Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates.

Source of the numbers

- IFRS Application Around the World – Jurisdictional Profile: Japan; IASB

- Voluntary Application of IFRS (Current and scheduled); Tokyo Stock Exchange

- IFRS Adoption Report; Financial Services Agency

Meet the IFRS team

KPMG Executive Education

CPE seminars and customized training

Explore more

Converting from US GAAP to IFRS

To properly plan an effective transition, we offer ten factors for success plus five key things to consider.

Read moreMeet our team

Subscribe to the IFRS® Perspectives Newsletter

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.