Footnotes

1 IFRS 17, Insurance Contracts, replaces IFRS 4, Insurance Contracts

2 IFRS 9, Financial Instruments, and IFRS 15, Revenue from Contracts with Customers

3 ASC 944, Financial Services—Insurance

IFRS 17 will require fundamental accounting changes to how insurance contracts are measured and accounted for.

August 1, 2017, the IASB issued its comprehensive new accounting model for insurance contracts, IFRS 171 – replacing its 2004 ‘temporary’ standard (IFRS 4). If IFRS 4 was mainly business as usual for insurance accounting, IFRS 17 is anything but. The new standard will require fundamental accounting changes to how insurance contracts are measured and accounted for. It also differs significantly from US GAAP.

Overview: IFRS 17

As it was under IFRS 4, the new insurance standard applies to insurance or reinsurance contracts issued and reinsurance contracts held. These may even exist within a noninsurance company.

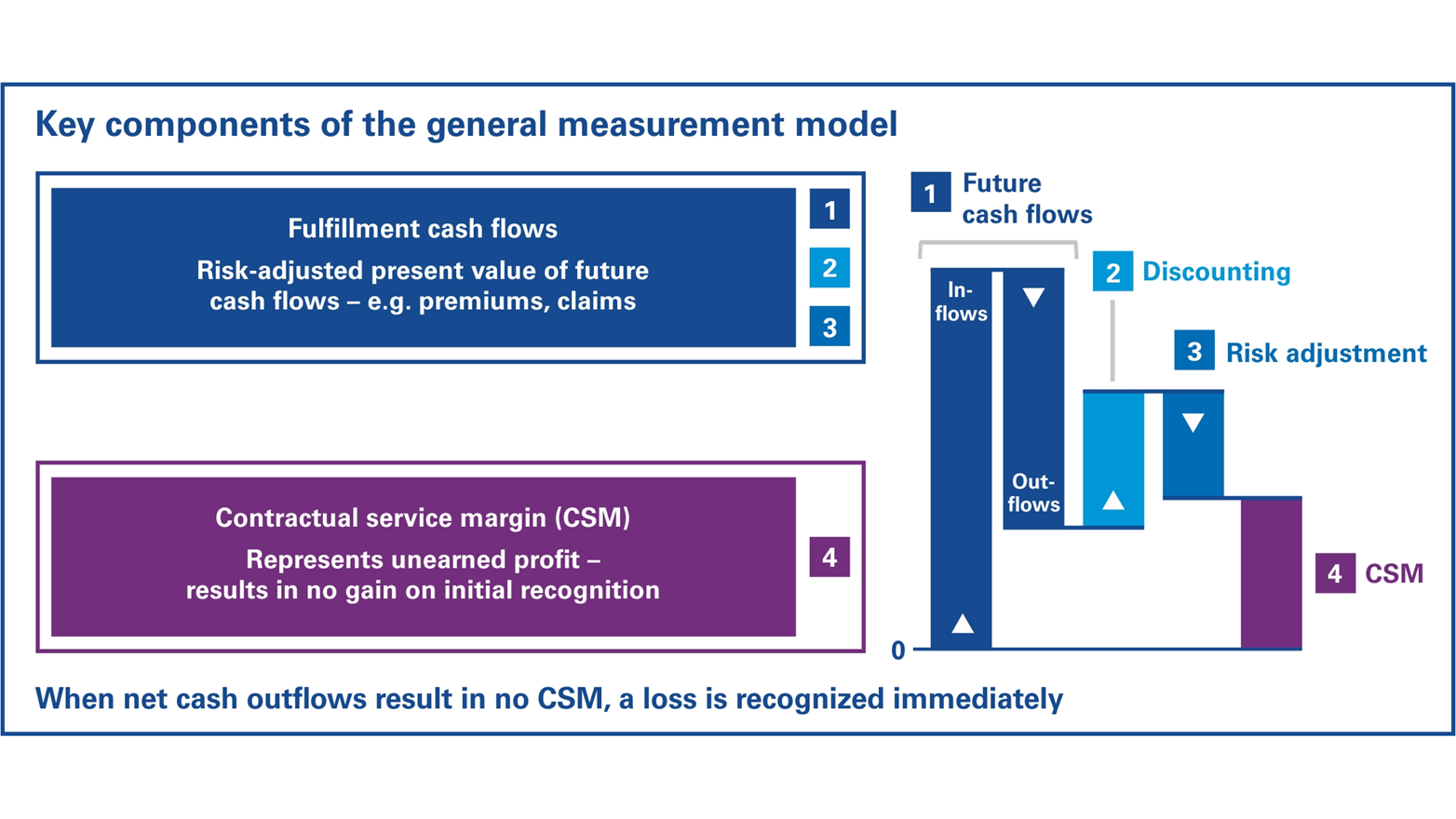

IFRS 17 brings greater comparability and transparency about the profitability of insurance contracts and gives users more insights into an insurer’s financial health. IFRS 17 introduces the general measurement model, which is based on a risk-adjusted present value of future cash flows that will arise as the insurance contract is fulfilled. The new measurement model aims to provide relevant information about the future cash flows.

A company applying IFRS 17 will need to remeasure its estimates each reporting period using current assumptions, which could require significant effort and new processes and controls.

The aggregation of contracts into ‘groups’ as defined by IFRS 17 is required at initial recognition and is not reassessed subsequently. Contract grouping is performed in a manner that limits the offsetting of profitable contracts against loss-making ones and cannot include contracts issued more than one year apart; however, exceptions apply in certain circumstances on transition. Generally, this will result in the grouping of contracts for presentation purposes below the portfolio of insurance contracts level as some companies may do now.

While the general measurement model applies to all groups of insurance contracts in the scope of IFRS 17, a simplified approach – the premium allocation approach (PAA) – may be used (optional) to measure contracts that meet certain criteria. Separately, the general measurement model is modified (mandatory) for the measurement of reinsurance contracts held, direct participating contracts and investment contracts with discretionary participation features.

IFRS 17 also includes new disclosure requirements aimed to deliver clarity and transparency for users of financial statements. Companies will have to consider the level of detail necessary to satisfy the disclosure requirements, which may result in some companies disclosing information at a more granular level. The required reconciliations help to explain drivers of change in the contract liability and different types of information about the insurance service results.

IFRS 17 is effective for annual reporting periods beginning on or after January 1, 2021. Early adoption is permitted only when a company applies the new financial instruments and revenue standards2 on or before the date of initial application of IFRS 17.

Implementation efforts for IFRS 17 will vary depending on the systems, methods and data storage capabilities currently used to measure and track insurance contracts, account for, report and disclose related information.

Being able to group contracts to apply the general measurement model may require significant effort and changes in how insurance contracts are measured and how their results are reported to users. Some companies may currently measure insurance contracts at a level (e.g. portfolio level) that includes both profit-making and loss-making contracts, thereby offsetting losses and gains. When applying the grouping requirements of IFRS 17, these contracts will no longer be able to be grouped. Accordingly, the effect of loss-making contracts will be recognized in profit or loss immediately, but the expected profit from profit-making contracts will be recognized as service is provided (i.e. over the expected life of the contract).

Applying the general measurement model will require companies to track certain historical information to determine the contractual service margin (e.g. tracking of discount rates to determine the present value of estimates of future cash flows). Many legacy systems are still in use and may not be capable of accommodating the new data needs of IFRS 17, resulting in necessary systems and processes upgrades. Companies will also have to develop controls around any system and process changes and develop or upgrade existing controls for business as usual after transition. A successful implementation effort will need cross-functional collaboration between IT, actuarial, finance, accounting and operations.

There are benefits for companies that take advantage of this opportunity to gain new insights from data analysis and reporting and to improve process efficiency. With a change of this magnitude, companies should be motivated to invest in solutions that achieve efficiencies.

While IFRS 17 mostly applies to insurance companies, noninsurance companies may also issue contracts that include insurance risks and are within the scope of IFRS 17.

Fixed-fee service contracts, such as roadside assistance programs and certain financial guarantee contracts, may meet the definition of an insurance contract. However, when certain specified conditions in IFRS 17 are met, a company may exclude such contracts from the scope of IFRS 17. It then accounts for fixed-fee service contracts like other service contracts with customers and financial guarantee contracts under the financial instruments standards. This election is made on a contract-by-contract basis and is irrevocable.

The definition of an insurance contract has not changed significantly from IFRS 4. However, noninsurers that issue contracts that meet this definition, and either are required or choose to apply IFRS 17, will no longer be able to apply their preexisting accounting policies as they did under IFRS 4. These companies might need to involve actuarial resources and change their systems, processes and controls to accommodate the new requirements.

An insurance contract is a contract under which one party (the issuer) accepts ‘significant insurance risk’ from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event adversely affects the policyholder. | Insurance risk is risk, other than financial risk, transferred from the holder of a contract to the issuer. |

Under IFRS 4, a US company that applies IFRS may account for insurance contracts using US GAAP. That will no longer be an option under IFRS 17, which means that dual reporters will need to maintain at least two different sets of financial reporting records upon adoption of IFRS 17 because of the different accounting models.

For example, under US GAAP, there are certain insurance products (such as term life or whole life) that are not required to be measured using current assumptions as mandated by IFRS 17. Discount rates determined under IFRS 17 (the top-down or bottom-up approach) will differ from current US GAAP application. An explicit risk adjustment is required as part of measurement under IFRS 17, but not under US GAAP. And US companies are likely measuring their insurance contracts using groupings that do not meet the IFRS 17 grouping requirements. The disclosure requirements are also key for US companies because the volume and nature of disclosures required by IFRS 17 differ greatly from US GAAP.

The FASB recently revised the disclosures for short-duration contracts, and is working on an ASC 9443 project to improve, simplify and enhance the financial reporting for long-duration contracts issued by insurance companies (see below). However, those changes are likely to differ significantly from the requirements of IFRS 17. Unfortunately for dual reporters, there are no convergence plans between ASC 944 and IFRS 17.

At this early stage, many US companies that are subsidiaries of foreign companies are waiting on instructions from their foreign headquarters. But with potential implementation issues that may require significant time and resources to address, it is never too early to start the conversations. Additionally, many US insurers may have the extra effort of potential changes to the accounting and disclosures for long-duration insurance contracts under US GAAP, and statutory accounting requirements under principles-based reserving requirements. Ideally, companies should consider these changes and their related effects on their people, processes and systems holistically.

To learn more about IFRS 17, read KPMG's publication, Insurance Contracts First Impressions, which includes our insights and detailed analysis of the effects of IFRS 17.

The FASB has identified four areas for improvements in its ASC 944 project:

The FASB issued its exposure draft of targeted improvements in September 2016, and is currently redeliberating based on the comments received.

1 IFRS 17, Insurance Contracts, replaces IFRS 4, Insurance Contracts

2 IFRS 9, Financial Instruments, and IFRS 15, Revenue from Contracts with Customers

3 ASC 944, Financial Services—Insurance

CPE seminars and customized training

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.